3 Key Takeaways:

- Compliance with the Corporate Transparency Act: The Corporate Transparency Act (CTA) became effective on January 1, 2024, so rental property owners using LLCs must determine whether they need to file a Beneficial Ownership Information (BOI) report to comply with new regulations aimed at increasing transparency and combating illicit activities.

- Do Rental Property Owners Need to File a Beneficial Ownership Information Report: The BOI reporting requirements mandate that companies, including rental property LLCs, provide detailed information about their beneficial owners to FinCEN. This includes personal details of individuals who either exercise substantial control over the company or own a significant portion of it.

- Consequences of Non-Compliance: Failure to comply with the BOI reporting requirements can lead to severe penalties, including substantial daily fines and potential imprisonment. This emphasizes the importance for rental property owners to understand and meet their filing obligations.

As a rental property owner, you may wonder: do I need to file a beneficial ownership report for my LLC? With the new Corporate Transparency Act (CTA) coming into effect on January 1, 2024, many small business owners, including rental property owners, face this important question. This blog post will guide you through the key aspects of the Beneficial Ownership Information (BOI) reporting requirements and help you determine if your rental property LLC needs to comply.

Understanding the Beneficial Ownership Information (BOI) Reporting Requirement

The Corporate Transparency Act, enacted as part of the Anti-Money Laundering Act of 2020, requires certain companies to report information about their beneficial owners to the Financial Crimes Enforcement Network (FinCEN). This new regulation aims to combat money laundering, tax fraud, and other illicit activities by increasing transparency in company ownership structures.

This new requirement could have significant implications for rental property owners who have formed LLCs or other entities to hold their properties. Let’s explore the specifics of the BOI reporting requirement and how it applies to rental property LLCs.

Why Real Estate Investors Use LLCs for Rental Properties

Whether it’s a single-member LLC or a partnership with multiple members, it’s common for many real estate investors to incorporate and put their investment property into an LLC for several reasons:

Legal Protection

One of the primary reasons real estate investors use LLCs is for legal protection. By holding rental properties in an LLC, investors can separate their personal and business assets. This means that if the LLC is sued or faces financial difficulties, the owner’s personal assets (such as their home, car, and personal savings) are generally protected from creditors.

Privacy

LLCs can also help keep the owners’ information private. In many states, the names of LLC members are not required to be publicly disclosed, which can provide an additional layer of privacy for investors. This can be particularly beneficial for high-profile individuals or those who prefer to keep their investment activities confidential.

Credibility

Operating a rental property through an LLC can also lend credibility to the business. It shows tenants, lenders, and other stakeholders that the investor is serious about their business and has taken steps to formalize their operations.

Who Needs to File a Beneficial Ownership Report?

Generally, if you’ve created an LLC, corporation, or other entity by filing a document with a secretary of state or equivalent office to own your rental properties, you’ll likely need to file a BOI report. This applies to both domestic entities created in the U.S. and foreign entities registered to do business in the U.S.

However, there are 23 exemptions to this reporting requirement. While the rental property industry doesn’t have specific exemptions, some larger rental property companies may qualify for the “large operating company” exemption. This exemption applies to companies with more than 20 full-time employees in the U.S., operating from a physical office in the U.S., and having filed a federal tax return for the previous year showing more than $5 million in gross receipts or sales from U.S. sources.

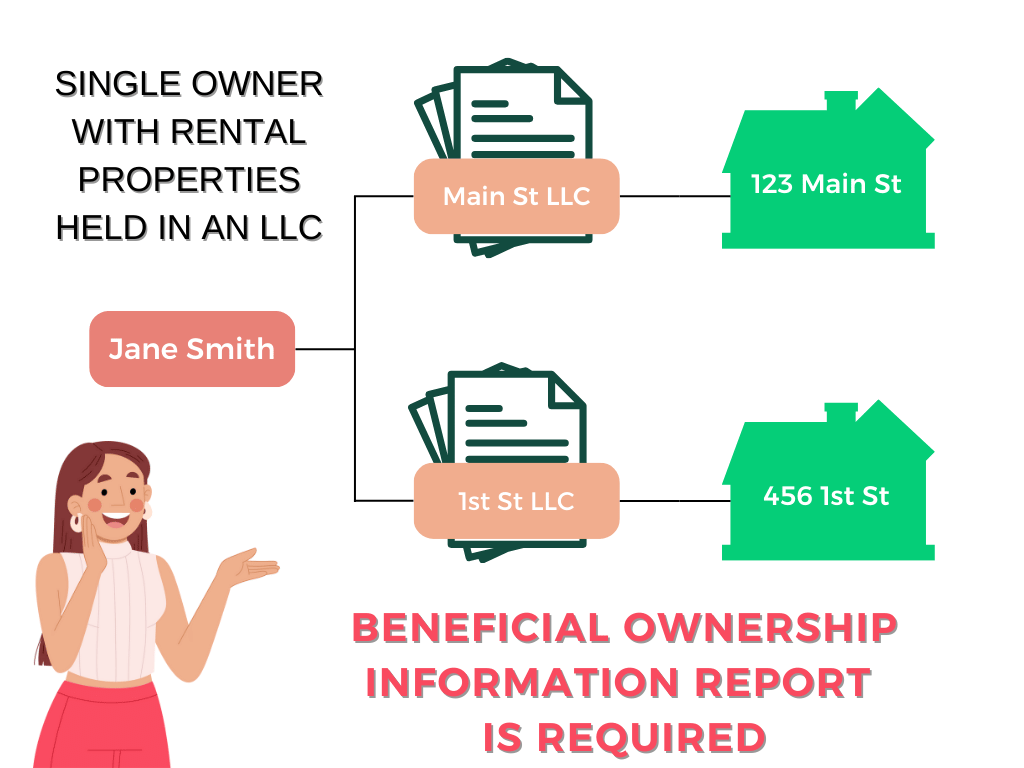

Here are some examples of entity structures and who would be required to file a beneficial ownership information report:

The example above shows Jane Smith, who owns two Limited Liability Companies (LLCs): Main St LLC and 1st St LLC, each of which owns a distinct investment property. This structure allows Jane to manage her rental properties under separate legal entities while retaining full ownership and control over both businesses.

Despite the anonymity and asset protection that LLCs offer, Jane must file a Beneficial Ownership Information (BOI) report for each LLC. This report is a regulatory requirement to disclose information about those who own or control a significant stake in a business.

Steps that Jane will take include:

- Start – Identify Ownership Structure: The ownership structure in this scenario is rather straightforward since Jane is the sole owner and control person for both Main St LLC and 1st St LLC.

- Determine Reporting Requirement: The next step is determining whether these LLCs are required to file BOI reports. Given that neither Main St LLC nor 1st St LLC qualifies for exemptions under the Corporate Transparency Act (CTA), such as the “large operating company” exemption (which generally involves having more than 20 employees and $5 million in annual revenue), Jane must file a BOI report for each LLC.

- Gather Required Information: Jane must collect the necessary details for the BOI report, including her full legal name, date of birth, residential address, and a unique identifying number, such as a driver’s license or passport number.

- File the BOI Report: Jane then submits this BOI report for each LLC. This submission is crucial for compliance with the CTA’s requirements on beneficial ownership transparency.

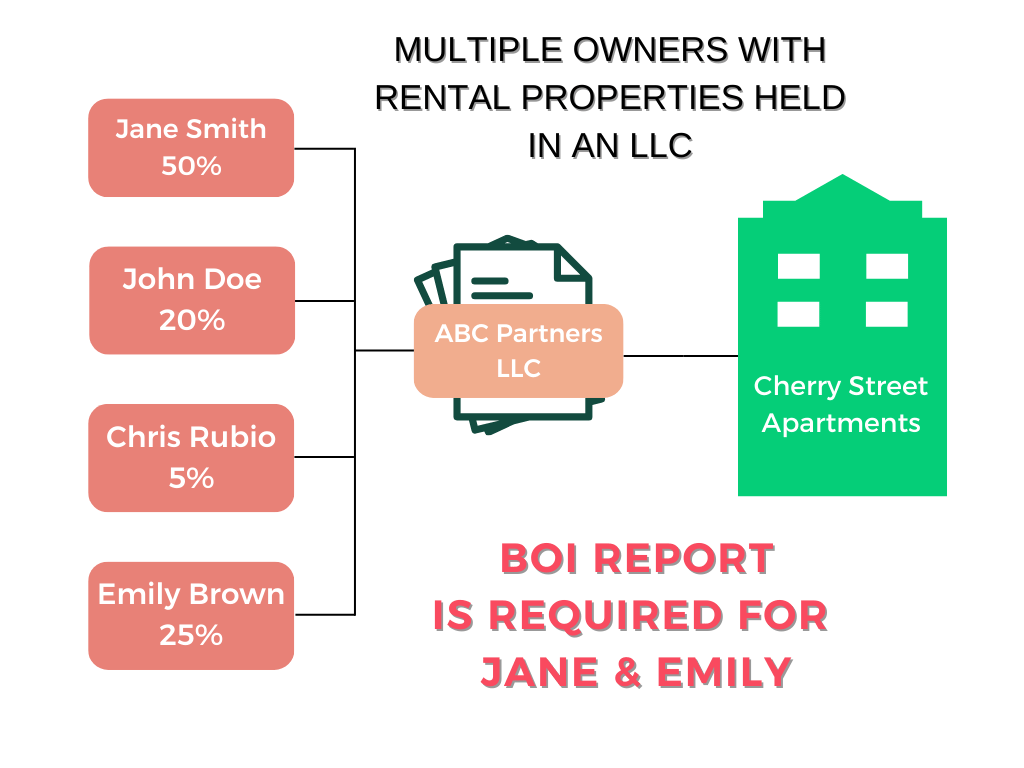

This diagram depicts a partnership structure where multiple investors jointly own an LLC that holds an apartment complex. Jane and Emily are highlighted as key figures, each possessing 25% or more ownership in the LLC. This significant ownership stake requires them to be listed on the Beneficial Ownership Information (BOI) report.

The other partners, who own less than 25% and are not considered control persons, are exempt from BOI reporting requirements. This structure underscores the importance of accurately identifying and reporting individuals with substantial influence or ownership to comply with regulatory standards. Click here to read more about complex ownership structures and how to file your BOI report accurately.

This ownership model is standard across various investment scales, from small partnerships to large real estate investment trusts (REITs). In these arrangements, investors combine resources to acquire and manage real estate assets through an LLC or similar entity.

However, if the investment meets specific criteria—such as having more than 20 full-time employees, a physical office in the U.S., and over $5 million in gross receipts—it may qualify as a “large operating company.” In this case, the LLC would be exempt from filing a BOI report under the Corporate Transparency Act. This exemption aims to reduce reporting burdens on well-established entities already subject to extensive regulatory oversight.

What Information Do I Need to Report for My Rental Property LLC?

If your rental property LLC is required to file a BOI report, you’ll need to provide the following information about your company:

- Legal name

- Trade names or “doing business as” (DBA) names

- Principal place of business address

- Jurisdiction of Formation

- Taxpayer identification number

Additionally, you’ll need to report information about each beneficial owner of your LLC, including:

- Legal name

- Date of birth

- Residential address

- Unique identifying number from an acceptable document (e.g., passport, driver’s license, or state ID)

- An image of the identifying document

For LLCs created on or after January 1, 2024, you’ll also need to provide similar information for the company applicant(s) – the individual(s) who filed the formation documents for your LLC.

Who Qualifies as a Beneficial Owner for a Rental Property LLC?

Understanding who qualifies as a beneficial owner is crucial for rental property owners. A beneficial owner is defined as an individual who, directly or indirectly, either:

- Exercises substantial control over the company, or

- Owns or controls at least 25% of the company’s ownership interests

For rental property LLCs, this typically includes:

- Individual investors who own 25% or more of the LLC

- Managing members or individuals with decision-making authority

- Individuals with the power to appoint or remove senior officers

It’s important to note that even if no individual owns 25% or more of your LLC, you’ll still need to report individuals who exercise substantial control over the company.

When Do I Need to File the Beneficial Ownership Report?

The deadline for filing your BOI report depends on when your rental property LLC was formed:

- For LLCs existing before January 1, 2024: You have until January 1, 2025, to file your initial report.

- For LLCs formed on or after January 1, 2024: You must file within 90 days of formation or registration.

After the initial filing, you must report any changes to the information within 30 days of the change occurring.

Consequences of Non-Compliance

Failing to comply with the BOI reporting requirements can result in severe penalties. These include civil penalties of up to $500 per day that the violation continues and potential criminal penalties, including fines of up to $10,000 and imprisonment for up to two years.

Strategies for Rental Property Owners with Multiple LLCs

Many rental property owners use separate LLCs for each property or investment. If this applies to you, you might be concerned about the potential administrative burden of filing multiple BOI reports. Fortunately, FinCEN has introduced the concept of a “FinCEN Identifier” to help streamline this process.

The FinCEN Identifier is a unique number that FinCEN assigns to an individual or entity. Once you’ve obtained a FinCEN Identifier, you can use it instead of providing your personal information each time you file a BOI report for one of your LLCs. This can significantly reduce the reporting burden for investors with multiple entities.

Do Rental Property Owners Need to File a Beneficial Ownership Information Report for Their LLC? A Few Final Thoughts

Understanding who needs to file a BOI report is crucial for compliance with the Corporate Transparency Act. Rental property owners must accurately identify beneficial owners and control persons within their LLCs. Doing so ensures they meet FinCEN requirements and contribute to the CTA’s transparency goals.

Are you ready to file your BOI report? Don’t let the complexities of beneficial ownership reporting overwhelm you. Our user-friendly platform integrates with FinCEN’s BOI Secure Filing System, making it easy for rental property owners to comply with the new regulations. File your BOI report with confidence today!