What is the BOI report?

Top Questions Answered for Business Owners by: FinCENBOIFiling.com

Navigating the waters of Beneficial Ownership Information (BOI) reporting can seem daunting for many business owners. At FinCEN BOI Filing, we understand the challenges and are dedicated to providing a user-friendly, efficient solution to facilitate your BOI reporting process. In this article, we aim to answer the most common questions in a friendly, professional manner, ensuring you have a clear understanding of what’s expected.

What is BOI Reporting and Who Needs to Do It?

Beneficial Ownership Information (BOI) reporting is a regulatory requirement that mandates certain business entities to disclose information about their beneficial owners to the Financial Crimes Enforcement Network (FinCEN). The goal is to promote transparency and combat financial crimes such as money laundering, terrorist financing, and tax evasion by identifying the individuals who ultimately own or control the entity.

Who Needs to File the BOI Report? The requirement to file a BOI report applies to a broad range of business entities, including corporations, limited liability companies (LLCs), and other similar structures. Any company that meets the criteria set forth by the Corporate Transparency Act (CTA) must disclose its beneficial owners to the Financial Crimes Enforcement Network (FinCEN). Specifically, the CTA mandates that any individual who owns or controls at least 25% of the company’s equity or has significant influence over the entity must be reported.

Beyond just ownership, the requirement extends to individuals who have substantial control over the company’s activities, make significant decisions, or own a considerable stake. Compliance is crucial, as failure to submit accurate BOI reports can result in severe penalties, including substantial fines and legal repercussions.

Navigating Complex Ownership Structures

Determining whether a company needs to file beneficial ownership information can be complicated when ownership structures involve multiple layers or entities. Some scenarios that can make this determination challenging include:

Companies with multiple owners spread across different entities or trusts may not have a single individual meeting the 25% ownership threshold for reporting. However, if those owners work in concert, they could be considered to have significant control over the company, potentially triggering reporting requirements. Careful analysis of ownership stakes and decision-making authority is necessary in such cases.

Additionally, companies owned by other corporate entities, rather than individuals, can obscure the trail of beneficial ownership. If the parent company has a complex ownership structure involving other businesses or trusts, it may be difficult to identify the ultimate individual owners or controllers. Regulators may need to “pierce the corporate veil” by looking through multiple layers of ownership to determine if reporting is mandated.

Determining Your Company’s BOI Reporting Requirement

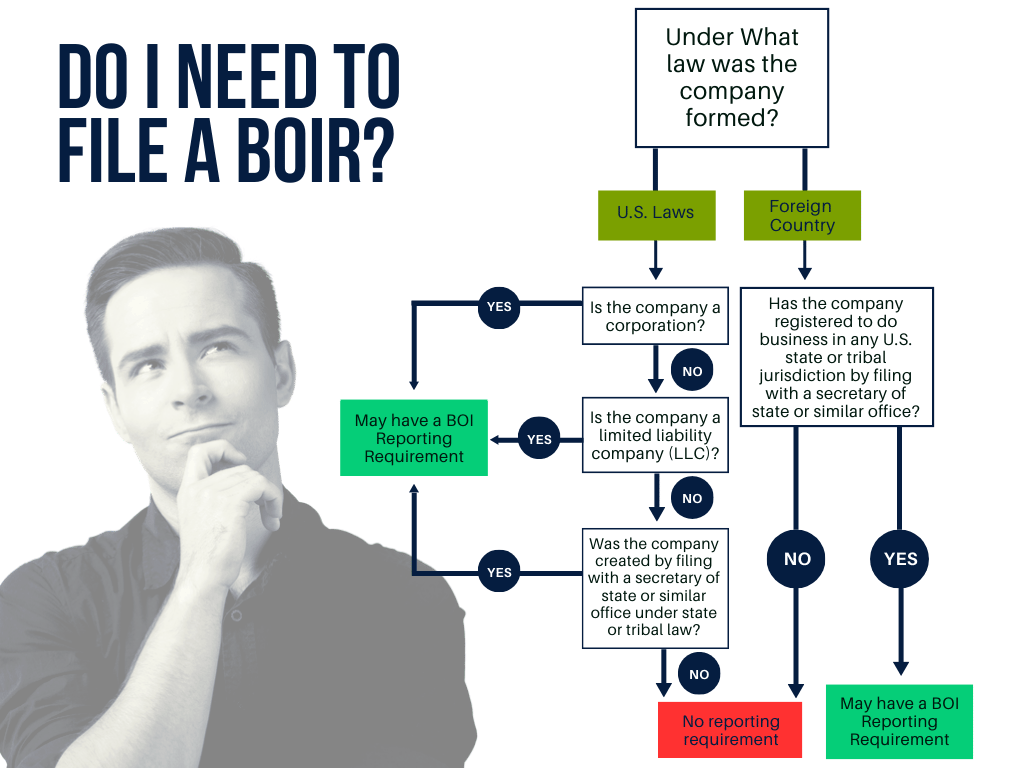

While the general rule is that most companies, including single-member LLCs, need to file a BOI report, the specifics of your company’s structure and ownership may affect this requirement. To help you determine if your company needs to file, we’ve created a flow chart that outlines the key decision points.

As illustrated in our flow chart, the filing requirement isn’t always straightforward, especially for companies with complex ownership structures. Companies with multiple owners spread across different entities or trusts may not have a single individual meeting the 25% ownership threshold for reporting. However, if those owners work in concert, they could be considered to have significant control over the company, potentially triggering reporting requirements. Careful analysis of ownership stakes and decision-making authority is necessary in such cases.

Additionally, companies owned by other corporate entities, rather than individuals, can obscure the trail of beneficial ownership. If the parent company has a complex ownership structure involving other businesses or trusts, it may be difficult to identify the ultimate individual owners or controllers. Regulators may need to “pierce the corporate veil” by looking through multiple layers of ownership to determine if reporting is mandated.

To find out quickly if you’re required to file a BOI report for your business, check out our free 2-minute Eligibility Quiz.

When are the BOI Reporting Deadlines?

- For Companies Established Before January 1, 2024: File your initial BOI report by January 1, 2025.

- For Companies Established Between January 1, 2024, and December 31, 2024: You have a 90-day window post-registration for filing.

- For Companies Established On or After January 1, 2025: The deadline is within 30 days of registration.

How Can I Prepare for BOI Reporting?

Preparing for BOI reporting involves understanding your obligations, gathering necessary information about your beneficial owners, and deciding your filing strategy. Staying informed with the latest guidelines is also key. You can prepare your BOI filing directly on our homepage.

To find out quickly if you must file a BOI report for your business, check out our free 2-minute Eligibility Quiz.

How Does FinCENBOIFiling.com Facilitate the BOI Reporting Process?

FinCEN BOI Filing has revolutionized the process of BOI reporting, catering to both individual filers and business service companies. Our platform offers a streamlined and user-friendly interface for individual filers, making it easy to submit BOI reports directly to FinCEN. This approach ensures compliance with minimal hassle, allowing users to input necessary details such as beneficial owners’ information securely and efficiently.

Moreover, FinCEN BOI Filing has empowered business service companies like attorneys and tax preparers by providing them with a white-labeled service. This service enables these professionals to embed our BOI filing form directly on their websites, offering a seamless experience for their clients. By leveraging our white-label solution, these firms can enhance their service offerings, maintain brand consistency, and earn revenue through BOI filing services.

What Are the Benefits of Using FinCENBOIFiling.com?

- Ease of Use: Our user-friendly questionnaire makes the BOI reporting process straightforward.

- Compliance Assurance: We ensure that your filings are compliant with current regulations.

- Time and Cost Efficiency: Our solution saves time and is offered at a reasonable price.

- Privacy & Security: We ensure confidentiality by securely transmitting reports to FinCEN via an approved API connection with their system.

How do I get started and file my FinCEN BOI report?

We simplify the process by offering you direct access to the online form right from our homepage at FinCENBOIFiling.com. Learn more about how we can streamline your reporting process, ensuring compliance without the stress.

BOI reporting is an essential aspect of modern business operations, albeit complex. With FinCENBOIFiling.com, you have a partner dedicated to simplifying this process, providing a cost-effective, user-friendly solution. Let us help you navigate BOI reporting, keeping your business compliant and informed.

Frequently Asked Questions

Have questions about the Beneficial Ownership Filing process? Check out FinCEN BOI Filing's frequently asked questions for the answer.

Are there penalties for not filing a BOI report?

Yes, failing to file a BOI report can result in substantial penalties, including hefty fines and potential legal repercussions. Learn more about the BOI deadlines and non-filing BOI penalties.

How do I file a BOI report?

Filing a BOI takes about 5-10 minutes and can be done here. If you’re not sure if you are required to file, you can take the one minute BOI Eligibility Quiz.

What is a BOI report?

Filing a BOI takes 5-10 minutes and can be done here. If you’re unsure if you are required to file, you can take the one minute BOI Eligibility Quiz.

What information is required in a BOI report?

You’ll need details of beneficial owners (name, address, ID number) and basic company information (name, address, registration details). Check out our ultimate guide to filing a BOI report for a complete list of items needed.

Who needs to file a BOI report?

Generally, most businesses, except for some exempt categories like publicly traded companies, are required to file a BOI report. For a comprehensive list of businesses who need to file, check out the essential guide to BOI reporting.

When is the BOI report due?

The due date for BOI reports varies based on jurisdiction and specific business circumstances. You can learn more about the BOI deadlines here.