Hey there, fellow Arkansans! If you’re a small business owner in the Natural State looking to give your venture a financial boost, you’re in for a treat.

Whether you’re running a cozy café in Little Rock or a tech startup in Fayetteville, there’s grant money out there waiting for you. In this article, we’ll explore where to find these hidden treasures of funding, faster than a Razorback can score a touchdown. Plus, we’ll walk you through the steps to qualify for these grants, making the process smoother than a glass of sweet tea on a hot Arkansas summer day.

Where to Search for Small Business Grants in Arkansas

Arkansas is a hidden gem for entrepreneurs, brimming with untapped potential and business opportunities just waiting to be discovered. With a little digging and the right resources, savvy business owners can uncover a treasure trove of grants and support programs designed to fuel their dreams and ignite success in the Natural State.

Some Arkansas Local Resources Include:

Arkansas’s Small Business Association: The SBA in Arkansas is a treasure trove of resources for entrepreneurs with big dreams and empty pockets. They’re like that savvy friend who always knows where to find the best deals, except in this case, it’s funding opportunities and business advice tailored to help you turn your entrepreneurial vision into reality.

The Arkansas SBA doesn’t directly offer grants, but they do provide invaluable guidance on navigating the grant landscape. They can point you towards state-specific programs, federal opportunities, and even private sector grants that might be perfect for your business idea. Think of them as your personal GPS for the sometimes confusing world of small business funding.

Arkansas’s Economic Development Agency: The Natural State’s economic powerhouse is a treasure trove for ambitious entrepreneurs seeking financial fuel. With a smorgasbord of resources, from detailed market research to networking opportunities, this agency is like a Swiss Army knife for business growth – versatile, reliable, and always ready to help you carve out your niche in the Arkansas economy.

The Arkansas Economic Development Commission offers the Arkansas Business and Industry Training Program (ABITP) grant, a gem for qualifying businesses looking to train new or existing workers. This grant is available to companies creating new jobs or investing in new technology that requires worker retraining. To be eligible, businesses must typically be in the manufacturing, information technology, or service industries and demonstrate a commitment to creating high-wage jobs in Arkansas.

Arkansas’s Chamber of Commerce: The Arkansas Chamber of Commerce is a goldmine for entrepreneurs seeking funding opportunities. They offer a comprehensive database of local and state-level grants, loans, and investment programs tailored to small businesses. Their expert advisors can guide you through the application process, increasing your chances of securing the capital you need to grow your venture.

The Arkansas Chamber of Commerce offers the Small Business Innovation Grant, a competitive program designed to support early-stage companies with innovative products or services. Eligible applicants must be Arkansas-based businesses with fewer than 50 employees and demonstrate significant potential for job creation and economic impact. The grant provides up to $50,000 in non-dilutive funding, which can be used for research and development, prototyping, or market validation activities.

Highlighted Grant: Boost Your Business with This Opportunity

We’re always on the lookout for opportunities that can help businesses grow, especially those owned by underrepresented groups. The Minority and Women-Owned Business Enterprise Grant from the Arkansas Economic Development Commission is a fantastic resource for entrepreneurs in Arkansas. This grant program aims to support and empower minority and women-owned businesses, providing them with the financial boost they need to expand their operations, hire new employees, or invest in essential equipment. If you’re a business owner in Arkansas looking to take your company to the next level, you’ll definitely want to click here to learn more about this incredible opportunity.

To qualify for this grant, you’ll need to meet certain criteria set by the Arkansas Economic Development Commission. Typically, your business must be at least 51% owned and controlled by a minority or woman entrepreneur, and you’ll need to be certified as a Minority or Women-Owned Business Enterprise. Additionally, you may need to demonstrate how the grant funds will be used to create jobs, increase revenue, or contribute to the economic development of Arkansas. It’s important to carefully review the application requirements and gather all necessary documentation before applying, as competition for these grants can be fierce.

Extra Help: Where to Find More Small Business Grants

When looking for small business grants, it may benefit you to look beyond the boundaries of Arkansas. Skip is your one-stop platform for discovering and securing the funding you need to start or grow your business. With thousands of grants ranging from $1,000 to $25,000, finding the perfect opportunity is just a click away.

Imagine having access to a user-friendly dashboard where you can track and apply for grants tailored to your business in Arkansas. Skip’s AI-assisted grant writing tool helps craft compelling applications that stand out, and with instant feedback, you can ensure your submission is top-notch every time.

Join the thriving community of entrepreneurs who have already reaped the benefits of Skip. With over $300,000 in grants donated and strong partnerships with government agencies and non-profits, Skip is dedicated to your success. Take the first step today and turn your business dreams into reality – Click Here to get started with Skip.

Grant Qualification: What You Need to Know

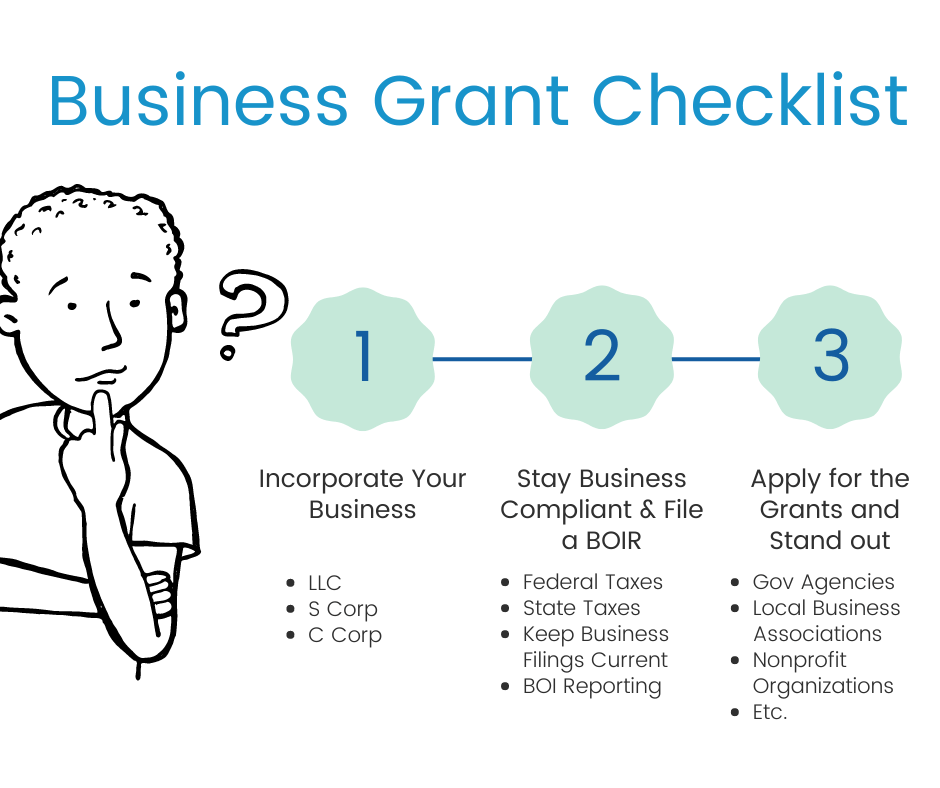

To qualify for most small business grants at both local and national levels, many organizations require that your business be incorporated. This is a crucial step for entrepreneurs in Arkansas looking to access funding opportunities. Incorporation not only enhances your credibility but also provides a formal structure that grant-giving bodies often prefer. It demonstrates your commitment to your business and can open doors to various financial resources that are typically unavailable to unincorporated entities.

For entrepreneurs seeking assistance with incorporation, Northwest Registered Agent has proven to be an excellent choice. Their expertise in helping business owners navigate the incorporation process is unparalleled. What sets them apart is their commitment to privacy and personalized service, ensuring that Arkansas entrepreneurs receive tailored support throughout the incorporation journey. By choosing Northwest Registered Agent, you’re not just incorporating your business; you’re partnering with a team dedicated to your success.

The Importance of BOIR for Grant Eligibility

Compliance isn’t just a box to check; it’s your ticket to opportunity. For entrepreneurs in Arkansas, staying on top of federal and state taxes, along with keeping business registrations current, isn’t merely about avoiding trouble—it’s about opening doors to grants that could fuel your growth. Think of it as the price of admission to a world of potential resources.

The Corporate Transparency Act has added a new layer to this compliance puzzle, requiring businesses to unveil their beneficial owners through a Beneficial Ownership Information Report. While it might feel like another bureaucratic hurdle, view it as a safeguard for your business’s future. The steep penalties for non-compliance make this a non-negotiable part of your business strategy, as essential as your product or service itself.

That’s where we come in. Navigating the Beneficial Ownership Information Reporting (BOIR) requirements can be daunting, but our website simplifies the process. We offer a secure and straightforward filing experience with a direct connection to FinCEN, ensuring your information is handled with the highest level of security. Our platform makes compliance effortless so you can focus on growing your business.

Don’t let penalties slow your business down. Failing to comply with Beneficial Ownership Information Reporting (BOIR) requirements can result in severe consequences. If you fail to file, you could be subject to the following penalties:

- Fines of up to $500 per day for failure to file BOIR

- Cumulative fines reaching up to $10,000

- A person who willfully violates the BOI reporting requirements may be subject to criminal penalties of up to two years imprisonment.

Not sure if you have a BOIR filing requirement? Please take our quick BOI eligibility quiz to determine whether you need to file and ensure you comply with regulations.

Final Thoughts: Securing Business Grants in Arkansas

In the end, building a successful business is about more than just finding funding. It’s about persistence, adaptability, and making the most of every opportunity. But for entrepreneurs in Arkansas willing to put in the work, these grant resources can provide that crucial boost to turn a dream into reality. Remember, every iconic company started somewhere. Your small business today could be tomorrow’s household name. The key is to start, stay curious, and never stop learning. Good luck on your entrepreneurial journey.

For all of you out there who haven’t yet tackled your BOIR, the time to act is now. Procrastination won’t get you anywhere, but taking just a few minutes to complete our straightforward form will. Don’t let this critical step in your compliance journey slip through the cracks—get it done and move forward with confidence.

Frequently Asked Questions

Have questions about the Beneficial Ownership Filing process? Check out FinCEN BOI Filing's frequently asked questions for the answer.

What is a BOI report?

A Beneficial Ownership Information (BOI) report is a filing required by FinCEN to disclose key details about individuals who own or control a company, ensuring compliance with anti-money laundering laws and enhancing corporate transparency. Filing a BOI takes 5-10 minutes and can be done here.

When does the CTA become effective?

The Corporate Transparency Act (CTA) reporting requirements take effect on January 1, 2024. Business entities established before this date have until January 1, 2025, to meet the reporting obligations.

Are there penalties for not filing a BOI report?

Yes, failing to file a BOI report can result in substantial penalties, including hefty fines and potential legal repercussions. Learn more about the BOI deadlines and non-filing BOI penalties.

How do I file a BOI report?

Filing a BOI takes about 5-10 minutes and can be done here. If you’re not sure if you are required to file, you can take the one minute BOI Eligibility Quiz.

Who is considered a beneficial owner?

A beneficial owner is any individual who either:

- Directly or indirectly exercises substantial control over the reporting company, or

- Directly or indirectly owns or controls 25% or more of the company’s ownership interests.

Substantial control includes the power to direct, influence, or determine significant decisions of the company. This may involve senior officers or individuals with authority to appoint or remove senior officers or a majority of the board.

Ownership interests encompass rights that establish ownership in the company, ranging from basic stock shares to more complex financial instruments.

For more details on “substantial control” and “ownership interests,” refer to our guide on complex ownership structures.

How do BOI reports get submitted to FinCEN?

We submit reports through a secure API connection directly with FinCEN’s Beneficial Ownership Secure System (BOSS). This integration allows for seamless and efficient filing of Beneficial Ownership Information reports, reducing the time it takes to complete and submit a report.

Our user-friendly form is designed to minimize errors by guiding you through the process with clear prompts and checks. Additionally, by using the secure API connection, we ensure that your data remains private and protected throughout the submission process, adhering to the highest security standards.

Who can access the beneficial ownership information?

The beneficial ownership information will be accessible only to authorized government agencies, such as law enforcement and regulatory authorities, for the purpose of combating money laundering, fraud, and other financial crimes.

This data is not publicly available and is used solely for compliance with legal and regulatory requirements. Only those with a legitimate need, as defined by the law, will be able to access this information to ensure transparency and uphold national security.

You can read more about keeping your personal information private when filing your BOIR.

Do I need to file a BOIR annually?

No, you do not need to file a Beneficial Ownership Information Report (BOIR) annually. However, you are required to update and file a new report if there are any changes to the beneficial ownership or company applicant information, such as changes in ownership or control. The report must be filed when there are material updates, but there is no annual filing requirement unless changes occur.

What information is required in a BOI report?

Type of Report

The reporting company must specify the type of report being submitted: an initial report, a correction of a prior report, or an update to a prior report.

Company Information

The reporting company must provide the following details:

- Legal Name: The official name of the company.

- Trade Name: Any “doing business as” (DBA) names used by the company.

- Address: The current street address of its principal place of business. If the principal place of business is outside the U.S., the company must report the address from which it conducts business in the U.S.

- Taxpayer Identification Number (TIN): This includes an EIN, SSN, or ITIN, as appropriate.

Beneficial Owner Information

The reporting company must provide the following details for each beneficial owner:

- Legal Name: The individual’s full legal name.

- Date of Birth: The individual’s date of birth.

- Address: The individual’s residential street address.

- Identification Document: A unique identifying number from an acceptable identification document, the issuing state or jurisdiction, and an image of the document.

Company Applicant Information (if required)

For reporting companies created on or after January 1, 2024, the following information about the company applicant must be provided:

- Address: The individual’s residential street address. If the applicant forms or registers companies as part of their business (e.g., paralegals), the business address can be used. The address does not need to be in the U.S.

- Identification Document: A unique identifying number from an acceptable identification document, the issuing state or jurisdiction, and an image of the document.

Who needs to file a BOI report?

Most businesses are required to file a BOI report, with exceptions for 23 specific categories, such as publicly traded companies and other regulated entities. To learn more about these exemptions and determine if your business needs to file, read this article.

When is the BOI report due?

- Companies formed or registered before January 1, 2024, must file an initial BOI report by January 1, 2025.

- Companies formed or registered in 2024 must file a BOI report within 90 days of receiving actual or public notice of their formation or registration.

- Companies formed or registered on or after January 1, 2025, must file their initial BOI report within 30 days of receiving actual or public notice.

You can learn more about the BOI deadlines here.

What is type of ID is required?

Acceptable identification documents include the following:

- A valid, unexpired driver’s license issued by a U.S. state or territory.

- A valid, unexpired ID card issued by a U.S. state, local government, or Indian Tribe for identification purposes.

- A valid, unexpired passport issued by the U.S. government.

- If none of the above is available, a valid, unexpired passport issued by a foreign government may be used instead.

An identification document must be collected for each beneficial owner.

For companies formed after 2023, an ID must also be provided for the company applicant.

Who is a company applicant?

A company applicant is the individual responsible for creating or registering a company. Specifically, it includes:

- The individual who directly files the document to form or register the entity with the relevant state or tribal authority, such as the Secretary of State.

- The individual primarily responsible for directing or controlling the filing process, even if they are not the one submitting it.

For companies formed or registered after January 1, 2024, this information must be reported as part of the Beneficial Ownership Information Report (BOIR).

Is it necessary to use a certified public accountant (CPA) or other professional to submit a BOI report?

Most individuals will be able to submit their Beneficial Ownership Information reports directly without needing assistance from attorneys or CPAs. Our streamlined, user-friendly form guides you through the process, making it simple to provide the required information accurately and efficiently.

Is a company required to update and correct information that is no longer accurate?

Yes, a company is required to update or correct its beneficial ownership information whenever it is no longer accurate. If there are any changes to the company’s beneficial owners or company applicant information, such as a change in ownership percentages or control, the company must file an updated report with the correct details. This ensures that the information on record remains accurate and compliant with the reporting requirements, helping to maintain transparency and reduce the risk of misuse.

Will I receive a confirmation of submission after submitting the BOIR?

After submitting your BOIR through our website, you will receive an email containing a unique submission process ID, confirming that your submission has been successfully received.

The email will also notify you once FinCEN has accepted your report. In rare instances, if your submission is rejected, we will inform you of the reason and provide a link to resubmit the corrected information.

You can track the status of all your submissions through our BOIR tracking page, ensuring you stay updated on the progress of your report. Most submission have a confirmed acceptance within a few minutes of submission.