Listen up, business owners. There’s a new sheriff in town, and its name is BOIR. The Beneficial Ownership Information Report deadline is barreling towards us like a freight train, and if you’re not on board, you might just get run over.

Understanding the BOI Reporting Requirement

BOI reporting, mandated by the Financial Crimes Enforcement Network (FinCEN), requires businesses to disclose information about their beneficial owners. This initiative aims to increase transparency in business operations and combat financial crimes. As the 2024 deadline approaches, businesses must understand the requirements and prepare accordingly.

Critical Deadlines You Can’t Afford to Miss

Here’s the nitty-gritty on when you need to file. Pay attention because these dates are as immovable as your ex’s opinion of you.

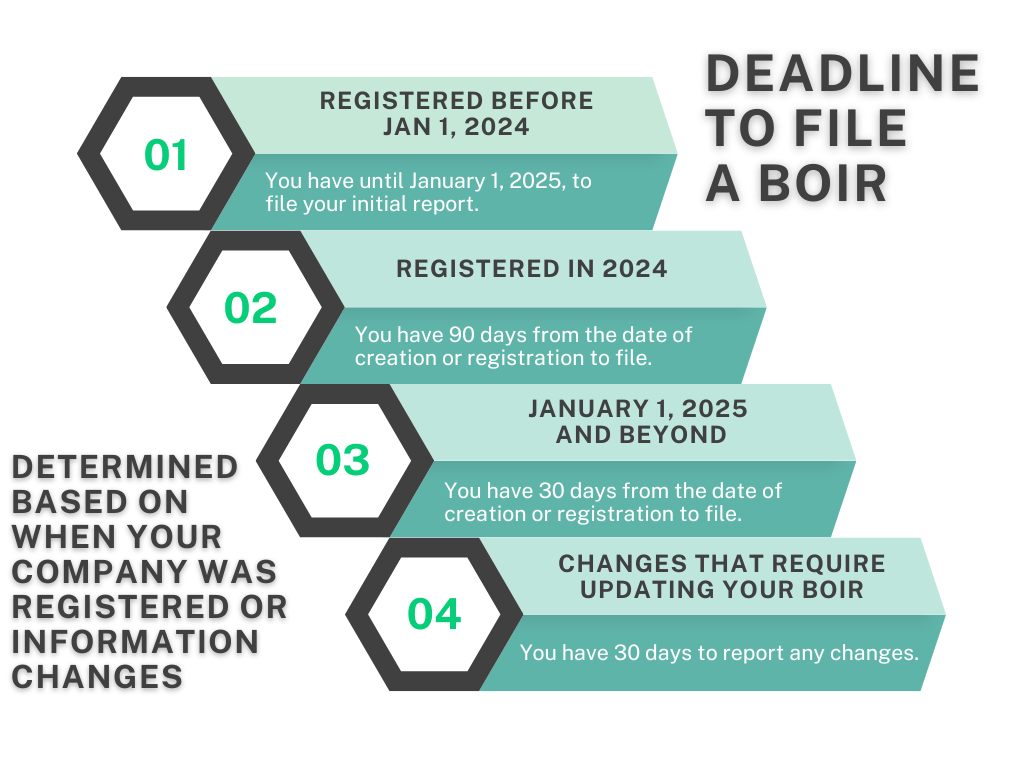

In 2024, the main thing to know is the BOIR deadline is determined based on when your company was registered:

- Before January 1, 2024: The starting gun fires. If your company was created before this date, you’ve got until January 1, 2025, to file your initial report.

- Companies created in 2024: You’ve got 90 days from the date of creation or registration to file.

- January 1, 2025, and beyond: Any new company has just 30 days from creation or registration to file.

- Updating your BOIR: Once you’ve filed, you’ve got 30 days to report any changes. No, “I forgot” isn’t an acceptable excuse.

The High Stakes of BOIR Compliance

Let’s cut through the bureaucratic jargon and get to the meat of the matter. The Financial Crimes Enforcement Network (FinCEN) needs to meet this new reporting requirement. They’re casting a wide net, and your business is caught in it. If you’ve created or registered a company in the US, congratulations—you’re in the BOIR club.

Now, here’s where things get interesting (and by interesting, I mean potentially wallet-draining). The BOIR deadline isn’t just another date on your calendar to ignore. Miss this one, and you could be looking at fines that’ll make your accountant weep. We’re talking up to $500 a day in civil penalties. Do the math—that adds up faster than your coffee budget.

But wait, there’s more! (And not in a good way.) Willful non-compliance could land you in the kind of striped suit you don’t want to wear—prison garb. Up to two years behind bars for playing dumb about BOIR? That’s a high price for procrastination.

Preparing for the BOI Reporting Deadline

- Determine Your Reporting Obligations: Assess who in your company needs to be included on the BOIR.

- Gather Necessary Information: Include details about your company’s beneficial owners, including their names, addresses, and identification.

- Stay updated when there are changes: When beneficial ownership or control person changes occur, it’s important to update this information on the BOIR within 30 days.

How We Make BOIR Filing Easy

We offer a comprehensive solution to ease the BOI reporting process. Our easy-to-use form is designed to assist business owners in efficiently navigating the complexities of BOI reporting.

We are now an approved third-party BOIR submission company with a secure API connection to FinCEN’s filing system. This allows us to submit forms securely and instantly when you hit the submit button. If there are any issues with your submission, we usually receive feedback within minutes.

Our simplified form helps users enter the correct information the first time. However, typos can still occur, causing your submission to be flagged. If this happens, we will quickly notify you so you can correct the error and resubmit without any issues.

Your information is never stored in our system, so you can be confident that it isn’t floating around waiting to be compromised, unlike many other companies that rely on manual processes. The typical process involves your sensitive data being collected and handled by people, increasing prices, the risk of errors, and information breaches. Our automated system, on the other hand, ensures a safer and more accurate submission process. Your data goes directly and securely to FinCEN without any middlemen.

Getting Started with FinCENBOIFiling.com

Don’t wait until the last minute to prepare for the BOI reporting deadline. Get ahead by visiting FinCENBOIFiling.com today. Learn more about our services and how we can confidently help you meet your BOI reporting obligations.

In conclusion, preparation and understanding are key as the 2024 BOI reporting deadline approaches. With FinCENBOIFiling.com, you have a partner who understands the intricacies of these requirements and offers a streamlined, cost-effective solution to ensure your business remains compliant. Join us in paving the way for a more transparent business environment.