3 Key Takeaways:

- Mandatory BOIR Filing for LLCs and Corporations:

- Risks of Non-Compliance: Failing to file a BOIR can result in significant financial and legal consequences, including civil and criminal penalties.

- Legal Protection Through Incorporation:

As professionals in the Bookkeeping Service field, understanding and complying with BOIR Reporting Requirements is crucial for the success and reputation of your business. Failure to accurately report Beneficial Ownership Information can result in hefty fines and damage to your credibility. In this blog, we will delve into the importance of BOIR Reporting Requirements for bookkeepers and the key information you need to know to stay compliant.

Readers will learn the ins and outs of BOIR Reporting Requirements, including who is considered a beneficial owner, what information needs to be reported, and how to properly document and submit this information. By understanding these requirements, bookkeepers can ensure they are meeting legal obligations and protecting their clients from potential risks. Stay tuned as we break down the complexities of BOIR Reporting Requirements and provide practical tips for staying on top of compliance in your bookkeeping services.

What is a BOIR?

A Beneficial Ownership Information Report (BOIR) is a document that discloses the individuals who ultimately own or control a company. The Corporate Transparency Act now requires most US companies, including LLCs and corporations, to file a BOIR with the Financial Crimes Enforcement Network (FinCEN). This new regulation aims to increase transparency and prevent money laundering and other illicit activities by identifying the true owners behind corporate entities.

For those in the Bookkeeping Service profession, complying with the BOIR requirement is crucial as many individuals who start bookkeeping businesses choose to incorporate with an LLC or Corporation. Failing to file a BOIR can result in significant fines and legal penalties, which can be detrimental to a bookkeeping business. Just like balancing the books is essential for financial health, ensuring compliance with the law through filing a BOIR is necessary for the legal health of a bookkeeping service. By staying on top of these regulatory requirements, bookkeepers can maintain a clean record and avoid any unwanted audits or legal issues down the line.

Penalties for Failing to File a BOIR

Failing to file a Beneficial Ownership Information Report (BOIR) can result in severe consequences:

Civil Penalties

Entities that do not file a BOIR may face fines of up to $500 per day for each day the report is not submitted. These penalties can accumulate quickly, potentially resulting in significant financial burdens for non-compliant businesses.

Criminal Penalties

Willful non-compliance or providing false information can lead to criminal charges. These may include:

- Fines of up to $10,000

- Imprisonment for up to two years

Correction Period

FinCEN may waive penalties for mistakes or omissions that are corrected within 90 days of the original report filing deadline. However, it’s uncertain how aggressively penalties will be assessed for late reports, missed deadlines, or incorrect information disclosures.

Discover the game-changing strategies top entrepreneurs use to leave their competitors in the dust—don’t miss out on these 7 killer secrets to skyrocketing your business!

Unlock the insider tips and tools top start-ups and businesses are using to dominate their industries

Why Choose FinCEN BOI Filing for Your BOIR Needs?

That’s where we come in. At FinCEN BOI Filing, we’ve developed a user-friendly submission form that makes filing your BOIR quick and hassle-free. Our intuitive interface allows you to complete the filing process in just minutes, ensuring that you remain compliant without the stress.

Our service prioritizes your security. We use a secure connection to submit your BOIR directly, ensuring that none of your sensitive data is stored. Unlike many competitors who rely on manual entry—where your information is handled by their employees before being submitted to FinCEN—our automated process minimizes the risk of errors and enhances data security, giving you peace of mind.

With FinCEN BOI Filing, you can trust that your BOIR will be submitted efficiently and securely, leaving you free to focus on what matters most—running your business. Don’t let the complexities of BOIR compliance slow you down. Let us handle the filing, so you can stay compliant and avoid costly penalties.

Not Incorporated Yet? Discover Why You Should and What You Need to Know

As a Bookkeeping Service professional, incorporating your business isn’t just about paperwork and formalities – it’s a powerful way to protect yourself and your venture. Whether you’re a seasoned entrepreneur or just starting out, understanding these benefits can be crucial for your business’s future. Incorporating can provide liability protection, tax advantages, and increased credibility for your Bookkeeping Service business. By taking this step, you can safeguard your personal assets and create a solid foundation for long-term success.

Creating a Legal Barrier

When you incorporate your bookkeeping service, you are establishing a distinct legal entity for your business. This separation serves as a protective barrier, safeguarding your personal assets from any potential business liabilities. In the event that your business is sued or incurs debts that it cannot cover, operating as a corporation ensures that only the company’s assets are vulnerable, leaving your personal finances secure.

By incorporating your bookkeeping service, you are creating a legal shield that shields your personal assets from any potential risks associated with your business. In a sole proprietorship, creditors have the ability to pursue your personal savings or assets, including your home, in the event of a lawsuit or financial difficulties. However, by operating as a corporation, you are able to shield your personal finances from such risks, as only the company’s assets are exposed to potential liabilities.

Protecting Your Privacy and Shielding Your Identity

In the world of Bookkeeping Service, it is important to understand how incorporating a business can add a layer of privacy for owners. By creating a separate legal entity through the formation of a corporation or LLC, owners can shield their personal identities from public records. This means that in many states, only the name and address of the registered agent and directors/officers need to be disclosed publicly, keeping the identities of shareholders or members confidential.

For those in the profession of Bookkeeping Service, states like Wyoming, Delaware, and New Mexico offer even greater privacy protections by allowing for anonymous LLCs where owner information is completely confidential. Utilizing a registered agent service can further obscure the owner’s identity and personal information. While not a foolproof method, incorporation can be a valuable tool for business owners looking to maintain their privacy and safeguard their personal information from public scrutiny.

Incorporating your business can provide a level of privacy by keeping much of your personal information out of public records, helping to maintain a degree of anonymity. However, it’s important to recognize that this privacy has its limits and does not eliminate all legal disclosure requirements. Under the Corporate Transparency Act (CTA), most new and existing small businesses are required to file a Beneficial Ownership Information (BOI) report with the Financial Crimes Enforcement Network (FinCEN), identifying the individuals who ultimately own or control the business.

This BOI report is mandatory for most corporations, LLCs, and other entities created by filing with a secretary of state. The information provided is not public and is stored in a secure, non-public database, accessible only to authorized government authorities for law enforcement, national security, or intelligence purposes. While financial institutions may access this information with the company’s consent for customer due diligence, the data remains highly secure and is not available to the general public, ensuring that incorporation still offers significant privacy benefits.

Our Top Recommendation for Incorporating and Using Registered Agents

Northwest Registered Agent isn’t just another business formation service – it’s your secret weapon for launching a successful, protected enterprise. Here’s why they stand out:

Expert Entity Selection Guidance – Northwest offers personalized advice to help you select the perfect business entity, whether it’s an LLC, corporation, or another structure. Their expertise streamlines the formation process, allowing you to focus on what truly matters – growing your business.

Unmatched Privacy Protection – Northwest is a leader in its unwavering commitment to privacy and asset protection. They go above and beyond by:

- Keeping ownership details confidential

- Providing a business address for official correspondence

- Keeping your personal address off public records

This level of privacy is invaluable for entrepreneurs who want to maintain a low profile and clearly separate their personal and business identities.

Nationwide Expertise You Can Trust With over 20 years of experience, Northwest offers a reliable, comprehensive solution for business formation and registered agent services. Their commitment to transparency, privacy, and exceptional support makes them a trusted partner for entrepreneurs across the country.

That’s why we confidently recommend Northwest Registered Agent to all of our clients. When you’re ready to launch your business with confidence and protection, Northwest has you covered.

Wrapping Up: The Importance of BOIR Reporting for Industry Bookkeeping Service

We understand that as a Bookkeeping Service, your main priority is to comply with the law and meet the necessary requirements. Filing a Beneficial Ownership Information Report (BOIR) is not about demonstrating ethical standards or transparency, but rather about following the legal obligations set forth by the government. By ensuring that you file your BOIR accurately and on time, you are not only avoiding potential penalties but also maintaining the integrity of your business operations. So, don’t wait any longer – File Your Beneficial Ownership Information Report today to stay in compliance with the law.

For those who haven’t already incorporated, it’s important to consider the legal benefits that come with doing so. By incorporating your Bookkeeping Service, you can protect your personal assets from any liabilities that may arise in the course of business. Additionally, incorporating can help maintain your privacy by shielding your identity from public records. These legal benefits not only provide peace of mind but also set a solid foundation for the growth and success of your business. So, take the necessary steps to incorporate your Bookkeeping Service and reap the legal advantages that come with it.

Frequently Asked Questions

Have questions about the Beneficial Ownership Filing process? Check out FinCEN BOI Filing's frequently asked questions for the answer.

Are there penalties for not filing a BOI report?

Yes, failing to file a BOI report can result in substantial penalties, including hefty fines and potential legal repercussions. Learn more about the BOI deadlines and non-filing BOI penalties.

How do I file a BOI report?

Filing a BOI takes about 5-10 minutes and can be done here. If you’re not sure if you are required to file, you can take the one minute BOI Eligibility Quiz.

What is a BOI report?

Filing a BOI takes 5-10 minutes and can be done here. If you’re unsure if you are required to file, you can take the one minute BOI Eligibility Quiz.

What information is required in a BOI report?

You’ll need details of beneficial owners (name, address, ID number) and basic company information (name, address, registration details). Check out our ultimate guide to filing a BOI report for a complete list of items needed.

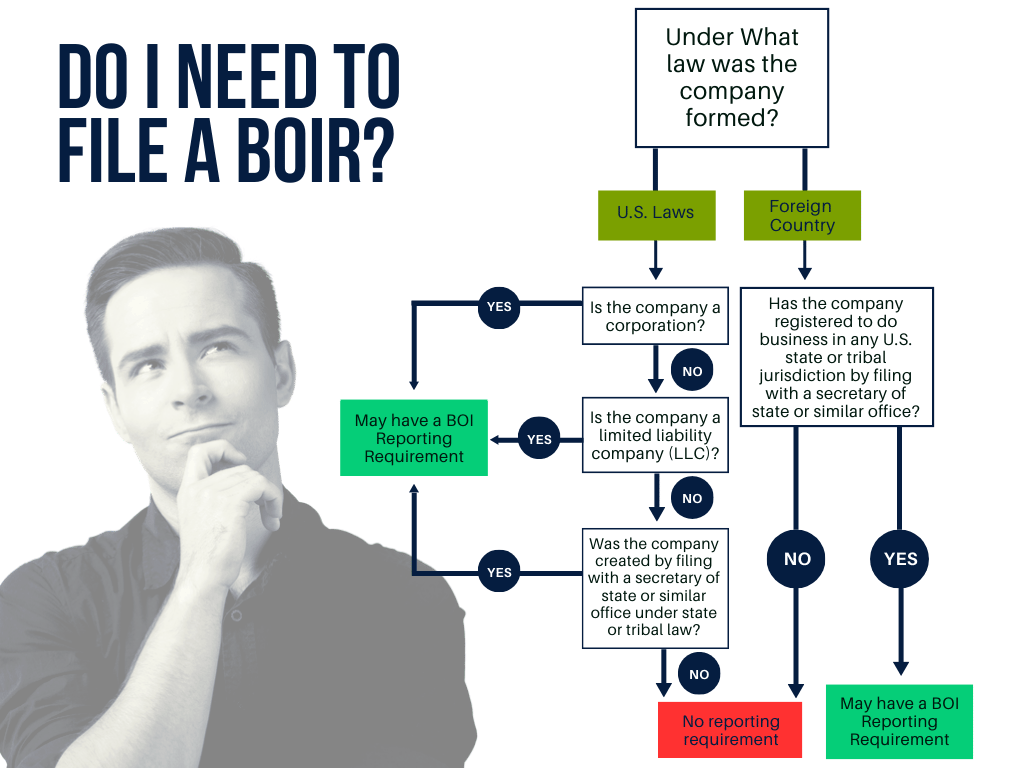

Who needs to file a BOI report?

Generally, most businesses, except for some exempt categories like publicly traded companies, are required to file a BOI report. For a comprehensive list of businesses who need to file, check out the essential guide to BOI reporting.

When is the BOI report due?

The due date for BOI reports varies based on jurisdiction and specific business circumstances. You can learn more about the BOI deadlines here.