3 Key Takeaways:

- Mandatory BOIR Filing for LLCs and Corporations:

- Risks of Non-Compliance: Failing to file a BOIR can result in significant financial and legal consequences, including civil and criminal penalties.

- Legal Protection Through Incorporation:

Hello, dear readers. Today, we delve into the intricate world of BOIR Reporting Requirements and why it is crucial for professionals in the E-learning Consultancy field to understand and comply with them. As the landscape of business regulations continues to evolve, staying informed and up-to-date on these requirements is essential for the success and longevity of your consultancy business.

In this blog, you will learn about the specific BOIR Reporting Requirements that apply to E-learning Consultancy professionals, the consequences of non-compliance, and how to effectively implement these regulations into your business operations. By gaining a thorough understanding of these requirements, you will not only ensure your compliance with the law but also enhance the credibility and reputation of your consultancy in the industry. Stay tuned as we explore the ins and outs of BOIR Reporting Requirements and their significance for your business.

What is a BOIR?

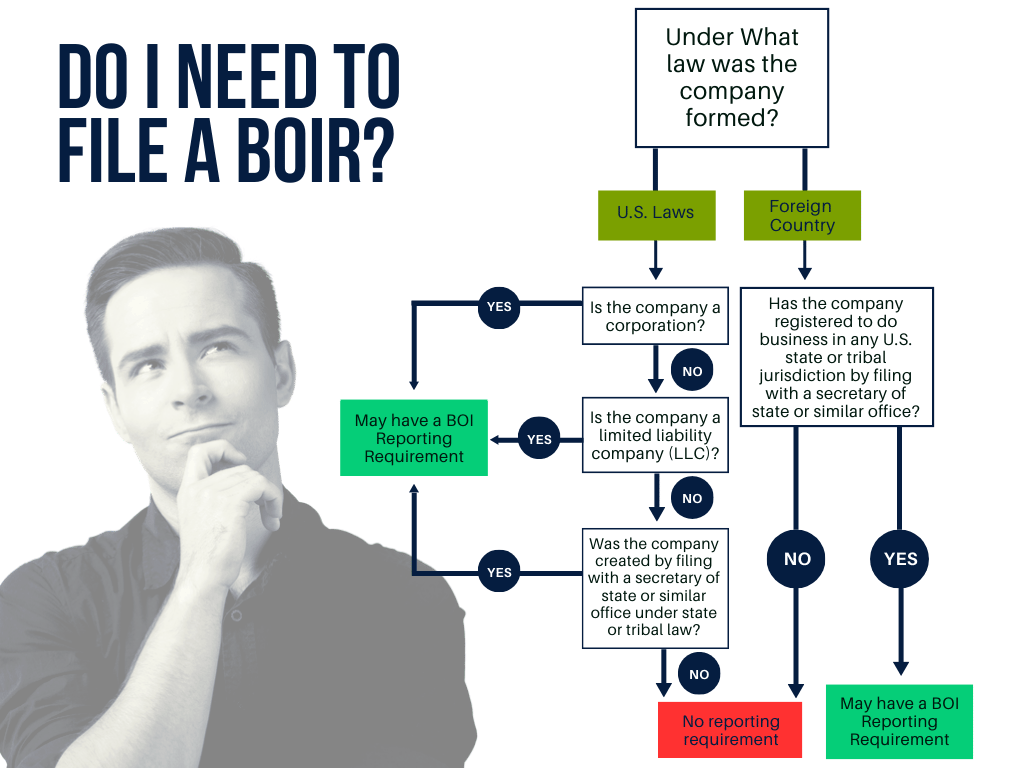

A Beneficial Ownership Information Report (BOIR) is a document that identifies the individuals who ultimately own or control a company. The Corporate Transparency Act now requires most US companies, including LLCs and Corporations, to file a BOIR with the Financial Crimes Enforcement Network (FinCEN). This new regulation aims to increase transparency and prevent money laundering and other illicit activities by making it harder for individuals to hide their ownership interests in companies.

For those in the E-learning Consultancy profession, starting a business often involves incorporating with an LLC or Corporation. As a result, many individuals in this field would be required to file a BOIR to comply with the Corporate Transparency Act. Just like ensuring that all links in an online course are working properly, filing a BOIR is a necessary step to avoid fines and legal penalties. By staying in compliance with this new regulation, E-learning Consultancy professionals can focus on creating engaging and effective online learning experiences for their clients without the worry of potential legal repercussions.

Penalties for Failing to File a BOIR

Failing to file a Beneficial Ownership Information Report (BOIR) can result in severe consequences:

Civil Penalties

Entities that do not file a BOIR may face fines of up to $500 per day for each day the report is not submitted. These penalties can accumulate quickly, potentially resulting in significant financial burdens for non-compliant businesses.

Criminal Penalties

Willful non-compliance or providing false information can lead to criminal charges. These may include:

- Fines of up to $10,000

- Imprisonment for up to two years

Correction Period

FinCEN may waive penalties for mistakes or omissions that are corrected within 90 days of the original report filing deadline. However, it’s uncertain how aggressively penalties will be assessed for late reports, missed deadlines, or incorrect information disclosures.

Discover the game-changing strategies top entrepreneurs use to leave their competitors in the dust—don’t miss out on these 7 killer secrets to skyrocketing your business!

Unlock the insider tips and tools top start-ups and businesses are using to dominate their industries

Why Choose FinCEN BOI Filing for Your BOIR Needs?

That’s where we come in. At FinCEN BOI Filing, we’ve developed a user-friendly submission form that makes filing your BOIR quick and hassle-free. Our intuitive interface allows you to complete the filing process in just minutes, ensuring that you remain compliant without the stress.

Our service prioritizes your security. We use a secure connection to submit your BOIR directly, ensuring that none of your sensitive data is stored. Unlike many competitors who rely on manual entry—where your information is handled by their employees before being submitted to FinCEN—our automated process minimizes the risk of errors and enhances data security, giving you peace of mind.

With FinCEN BOI Filing, you can trust that your BOIR will be submitted efficiently and securely, leaving you free to focus on what matters most—running your business. Don’t let the complexities of BOIR compliance slow you down. Let us handle the filing, so you can stay compliant and avoid costly penalties.

Not Incorporated Yet? Discover Why You Should and What You Need to Know

As professionals in the field of E-learning Consultancy, incorporating your business is not only a strategic move but also a necessary step to safeguard your expertise and services. By formalizing your business structure, you are not only protecting yourself but also positioning your consultancy for long-term success. Whether you are a seasoned expert in the industry or a newcomer looking to make your mark, recognizing the advantages of incorporation is essential for the growth and sustainability of your business.

Creating a Legal Barrier

When you incorporate your E-learning Consultancy, you are taking a crucial step in protecting your personal assets from potential business liabilities. By creating a separate legal entity for your business, you are establishing a legal shield that can safeguard your personal finances in the event of a lawsuit or debt accumulation that the company cannot repay. This means that in the unfortunate event of creditors coming after your business, your personal savings and assets, such as your home, will remain protected.

Incorporating your E-learning Consultancy not only provides a layer of protection for your personal assets but also ensures that only the company’s assets are at risk in case of any financial challenges. This legal separation between your business and personal finances can offer peace of mind and security as you navigate the world of e-learning consultancy. By understanding the benefits of incorporation, you can make informed decisions to safeguard your personal liability and protect your hard-earned assets.

Protecting Your Privacy and Shielding Your Identity

By incorporating your business, you can enjoy the added layer of privacy that comes with shielding your personal information from public records. When you establish a corporation or LLC, your business becomes its own legal entity separate from you as the owner. This means that in many states, only the name and address of the registered agent and directors/officers need to be disclosed publicly, keeping the identities of shareholders or members private.

States like Wyoming, Delaware, and New Mexico take privacy even further by allowing for anonymous LLCs, where owner information remains completely confidential. Utilizing a registered agent service can also help obscure your identity and personal details. While not a foolproof method, incorporation can be a valuable tool for E-learning Consultancy professionals looking to maintain their privacy and safeguard their personal information from public scrutiny.

Incorporating your business can provide a level of privacy by keeping much of your personal information out of public records, helping to maintain a degree of anonymity. However, it’s important to recognize that this privacy has its limits and does not eliminate all legal disclosure requirements. Under the Corporate Transparency Act (CTA), most new and existing small businesses are required to file a Beneficial Ownership Information (BOI) report with the Financial Crimes Enforcement Network (FinCEN), identifying the individuals who ultimately own or control the business.

This BOI report is mandatory for most corporations, LLCs, and other entities created by filing with a secretary of state. The information provided is not public and is stored in a secure, non-public database, accessible only to authorized government authorities for law enforcement, national security, or intelligence purposes. While financial institutions may access this information with the company’s consent for customer due diligence, the data remains highly secure and is not available to the general public, ensuring that incorporation still offers significant privacy benefits.

Our Top Recommendation for Incorporating and Using Registered Agents

Northwest Registered Agent isn’t just another business formation service – it’s your secret weapon for launching a successful, protected enterprise. Here’s why they stand out:

Expert Entity Selection Guidance – Northwest offers personalized advice to help you select the perfect business entity, whether it’s an LLC, corporation, or another structure. Their expertise streamlines the formation process, allowing you to focus on what truly matters – growing your business.

Unmatched Privacy Protection – Northwest is a leader in its unwavering commitment to privacy and asset protection. They go above and beyond by:

- Keeping ownership details confidential

- Providing a business address for official correspondence

- Keeping your personal address off public records

This level of privacy is invaluable for entrepreneurs who want to maintain a low profile and clearly separate their personal and business identities.

Nationwide Expertise You Can Trust With over 20 years of experience, Northwest offers a reliable, comprehensive solution for business formation and registered agent services. Their commitment to transparency, privacy, and exceptional support makes them a trusted partner for entrepreneurs across the country.

That’s why we confidently recommend Northwest Registered Agent to all of our clients. When you’re ready to launch your business with confidence and protection, Northwest has you covered.

Wrapping Up: The Importance of BOIR Reporting in Industry E-learning Consultancy

We understand that as a business owner of E-learning Consultancy, your main priority is to comply with the law and meet the necessary requirements. Filing a Beneficial Ownership Information Report (BOIR) is not just about demonstrating ethical standards or transparency; it is a legal obligation that must be fulfilled. By ensuring that you file your BOIR, you are not only following the law but also protecting your business from potential penalties and fines. So, don’t wait any longer – file your Beneficial Ownership Information Report today by clicking here.

For those who haven’t already incorporated, it is important to consider the legal benefits of doing so. Incorporating your business, such as E-learning Consultancy, can help shield your personal assets from any liabilities that may arise. Additionally, it can provide a layer of privacy protection by keeping your identity separate from your business. By taking this step, you are not only complying with the law but also safeguarding your business and personal assets. So, consider the benefits of incorporation and take the necessary steps to protect yourself and your business.

Frequently Asked Questions

Have questions about the Beneficial Ownership Filing process? Check out FinCEN BOI Filing's frequently asked questions for the answer.

What is a BOI report?

A Beneficial Ownership Information (BOI) report is a filing required by FinCEN to disclose key details about individuals who own or control a company, ensuring compliance with anti-money laundering laws and enhancing corporate transparency. Filing a BOI takes 5-10 minutes and can be done here.

When does the CTA become effective?

The Corporate Transparency Act (CTA) reporting requirements take effect on January 1, 2024. Business entities established before this date have until January 1, 2025, to meet the reporting obligations.

Are there penalties for not filing a BOI report?

Yes, failing to file a BOI report can result in substantial penalties, including hefty fines and potential legal repercussions. Learn more about the BOI deadlines and non-filing BOI penalties.

How do I file a BOI report?

Filing a BOI takes about 5-10 minutes and can be done here. If you’re not sure if you are required to file, you can take the one minute BOI Eligibility Quiz.

Who is considered a beneficial owner?

A beneficial owner is any individual who either:

- Directly or indirectly exercises substantial control over the reporting company, or

- Directly or indirectly owns or controls 25% or more of the company’s ownership interests.

Substantial control includes the power to direct, influence, or determine significant decisions of the company. This may involve senior officers or individuals with authority to appoint or remove senior officers or a majority of the board.

Ownership interests encompass rights that establish ownership in the company, ranging from basic stock shares to more complex financial instruments.

For more details on “substantial control” and “ownership interests,” refer to our guide on complex ownership structures.

How do BOI reports get submitted to FinCEN?

We submit reports through a secure API connection directly with FinCEN’s Beneficial Ownership Secure System (BOSS). This integration allows for seamless and efficient filing of Beneficial Ownership Information reports, reducing the time it takes to complete and submit a report.

Our user-friendly form is designed to minimize errors by guiding you through the process with clear prompts and checks. Additionally, by using the secure API connection, we ensure that your data remains private and protected throughout the submission process, adhering to the highest security standards.

Who can access the beneficial ownership information?

The beneficial ownership information will be accessible only to authorized government agencies, such as law enforcement and regulatory authorities, for the purpose of combating money laundering, fraud, and other financial crimes.

This data is not publicly available and is used solely for compliance with legal and regulatory requirements. Only those with a legitimate need, as defined by the law, will be able to access this information to ensure transparency and uphold national security.

You can read more about keeping your personal information private when filing your BOIR.

Do I need to file a BOIR annually?

No, you do not need to file a Beneficial Ownership Information Report (BOIR) annually. However, you are required to update and file a new report if there are any changes to the beneficial ownership or company applicant information, such as changes in ownership or control. The report must be filed when there are material updates, but there is no annual filing requirement unless changes occur.

What information is required in a BOI report?

Type of Report

The reporting company must specify the type of report being submitted: an initial report, a correction of a prior report, or an update to a prior report.

Company Information

The reporting company must provide the following details:

- Legal Name: The official name of the company.

- Trade Name: Any “doing business as” (DBA) names used by the company.

- Address: The current street address of its principal place of business. If the principal place of business is outside the U.S., the company must report the address from which it conducts business in the U.S.

- Taxpayer Identification Number (TIN): This includes an EIN, SSN, or ITIN, as appropriate.

Beneficial Owner Information

The reporting company must provide the following details for each beneficial owner:

- Legal Name: The individual’s full legal name.

- Date of Birth: The individual’s date of birth.

- Address: The individual’s residential street address.

- Identification Document: A unique identifying number from an acceptable identification document, the issuing state or jurisdiction, and an image of the document.

Company Applicant Information (if required)

For reporting companies created on or after January 1, 2024, the following information about the company applicant must be provided:

- Address: The individual’s residential street address. If the applicant forms or registers companies as part of their business (e.g., paralegals), the business address can be used. The address does not need to be in the U.S.

- Identification Document: A unique identifying number from an acceptable identification document, the issuing state or jurisdiction, and an image of the document.

Who needs to file a BOI report?

Most businesses are required to file a BOI report, with exceptions for 23 specific categories, such as publicly traded companies and other regulated entities. To learn more about these exemptions and determine if your business needs to file, read this article.

When is the BOI report due?

- Companies formed or registered before January 1, 2024, must file an initial BOI report by January 1, 2025.

- Companies formed or registered in 2024 must file a BOI report within 90 days of receiving actual or public notice of their formation or registration.

- Companies formed or registered on or after January 1, 2025, must file their initial BOI report within 30 days of receiving actual or public notice.

You can learn more about the BOI deadlines here.

What is type of ID is required?

Acceptable identification documents include the following:

- A valid, unexpired driver’s license issued by a U.S. state or territory.

- A valid, unexpired ID card issued by a U.S. state, local government, or Indian Tribe for identification purposes.

- A valid, unexpired passport issued by the U.S. government.

- If none of the above is available, a valid, unexpired passport issued by a foreign government may be used instead.

An identification document must be collected for each beneficial owner.

For companies formed after 2023, an ID must also be provided for the company applicant.

Who is a company applicant?

A company applicant is the individual responsible for creating or registering a company. Specifically, it includes:

- The individual who directly files the document to form or register the entity with the relevant state or tribal authority, such as the Secretary of State.

- The individual primarily responsible for directing or controlling the filing process, even if they are not the one submitting it.

For companies formed or registered after January 1, 2024, this information must be reported as part of the Beneficial Ownership Information Report (BOIR).

Is it necessary to use a certified public accountant (CPA) or other professional to submit a BOI report?

Most individuals will be able to submit their Beneficial Ownership Information reports directly without needing assistance from attorneys or CPAs. Our streamlined, user-friendly form guides you through the process, making it simple to provide the required information accurately and efficiently.

Is a company required to update and correct information that is no longer accurate?

Yes, a company is required to update or correct its beneficial ownership information whenever it is no longer accurate. If there are any changes to the company’s beneficial owners or company applicant information, such as a change in ownership percentages or control, the company must file an updated report with the correct details. This ensures that the information on record remains accurate and compliant with the reporting requirements, helping to maintain transparency and reduce the risk of misuse.

Will I receive a confirmation of submission after submitting the BOIR?

After submitting your BOIR through our website, you will receive an email containing a unique submission process ID, confirming that your submission has been successfully received.

The email will also notify you once FinCEN has accepted your report. In rare instances, if your submission is rejected, we will inform you of the reason and provide a link to resubmit the corrected information.

You can track the status of all your submissions through our BOIR tracking page, ensuring you stay updated on the progress of your report. Most submission have a confirmed acceptance within a few minutes of submission.