Hey there, Garden State entrepreneurs! Are you ready to give your small business a financial boost that’s as refreshing as a dip in the Jersey Shore? Let’s talk about small business grants in New Jersey – your ticket to turning that brilliant idea into a thriving reality.

Picture this: You’re sipping your favorite Wawa coffee, brainstorming ways to take your business to the next level, when suddenly – bam! – you stumble upon a goldmine of grant opportunities. Whether you’re dreaming of expanding your saltwater taffy empire on the Atlantic City Boardwalk or launching a tech startup in Newark’s bustling innovation district, we’ve got the inside scoop on where to find these grants and how to qualify. So, buckle up, fellow New Jerseyans – it’s time to navigate the world of small business grants with the same determination as the Devils chasing the Stanley Cup!

Where to Search for Small Business Grants in New Jersey

New Jersey’s bustling landscape is a treasure trove of untapped potential for savvy entrepreneurs willing to dig a little deeper. With a bit of persistence and know-how, you’ll uncover a wealth of grant opportunities just waiting to fuel your business dreams in the Garden State.

Some New Jersey Local Resources Include:

New Jersey’s Small Business Association: The Garden State’s SBA is a treasure trove for aspiring entrepreneurs seeking financial support. With a smorgasbord of resources, from loan programs to mentorship opportunities, they’re the fairy godparent every small business owner wishes they had. Their user-friendly website and knowledgeable staff make navigating the often-murky waters of business funding a breeze.

The New Jersey SBA doesn’t directly offer grants, but they do provide invaluable information on various grant opportunities available through other organizations and government agencies. They can guide you through the application process for programs like the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs, which are perfect for tech-savvy startups looking to turn their groundbreaking ideas into reality.

New Jersey’s Economic Development Agency: We’re excited to share that the NJEDA is a treasure trove for aspiring entrepreneurs. They offer a smorgasbord of resources, from funding opportunities to expert guidance, all designed to help you turn your business dreams into reality. It’s like having a supportive friend who just happens to have deep pockets and a wealth of business know-how.

The NJEDA does indeed offer a Small Business Improvement Grant Program. This gem provides reimbursement for up to 50% of total project costs, with a maximum grant of $50,000. It’s perfect for small businesses and nonprofits looking to revamp their facilities or purchase new furniture, fixtures, or equipment. If you’re a small business owner in a designated area of New Jersey with less than $5 million in annual revenue, you might just be the perfect candidate for this financial boost.

New Jersey’s Chamber of Commerce: The New Jersey Chamber of Commerce is a goldmine for entrepreneurs seeking funding opportunities. They offer a comprehensive database of grants, loans, and investment programs tailored specifically for businesses in the Garden State, making it easier for startups and small businesses to find the financial support they need to thrive.

The Chamber also provides a Small Business Growth Grant program, which offers up to $15,000 in matching funds for eligible businesses. To qualify, companies must have been in operation for at least two years, have fewer than 50 employees, and demonstrate a clear plan for using the funds to expand their operations or create new jobs in New Jersey.

Highlighted Grant: Boost Your Business with This Opportunity

Small business owners in New Jersey, listen up! The New Jersey Economic Development Authority has a fantastic opportunity for you with their Small Business Lease Assistance Program. This program is designed to help small businesses offset the costs of leasing commercial space, providing reimbursement of a portion of annual lease payments for up to two years. It’s particularly beneficial for businesses looking to expand or relocate within eligible areas of New Jersey. If you’re a small business owner struggling with high rental costs, this program could be a game-changer for your bottom line. To learn more about this incredible opportunity, click here for all the details.

To qualify for this program, your business must meet certain criteria. You’ll need to be a for-profit business with no more than 50 full-time equivalent employees and be planning to lease between 500 and 5,000 square feet of new or additional market-rate, first-floor office, industrial, or retail space for a minimum 5-year term. The property must be located in one of the designated eligible areas within New Jersey. Additionally, your business should be in good standing with the New Jersey Department of Labor and Workforce Development and the New Jersey Department of Environmental Protection. If you meet these qualifications, don’t miss out on this chance to boost your business’s growth and success.

Expand Your Search: Helpful Resources for Business Funding

When looking for small business grants, it may benefit you to look beyond the boundaries of New Jersey. Skip is your one-stop platform for discovering and securing the funding you need to start or grow your business. With thousands of grants ranging from $1,000 to $25,000, finding the perfect opportunity is just a click away.

Imagine having access to a user-friendly dashboard where you can track and apply for grants tailored to your business in New Jersey. Skip’s AI-assisted grant writing tool helps craft compelling applications that stand out, and with instant feedback, you can ensure your submission is top-notch every time.

Join the thriving community of entrepreneurs who have already reaped the benefits of Skip. With over $300,000 in grants donated and strong partnerships with government agencies and non-profits, Skip is dedicated to your success. Take the first step today and turn your business dreams into reality – Click Here to get started with Skip.

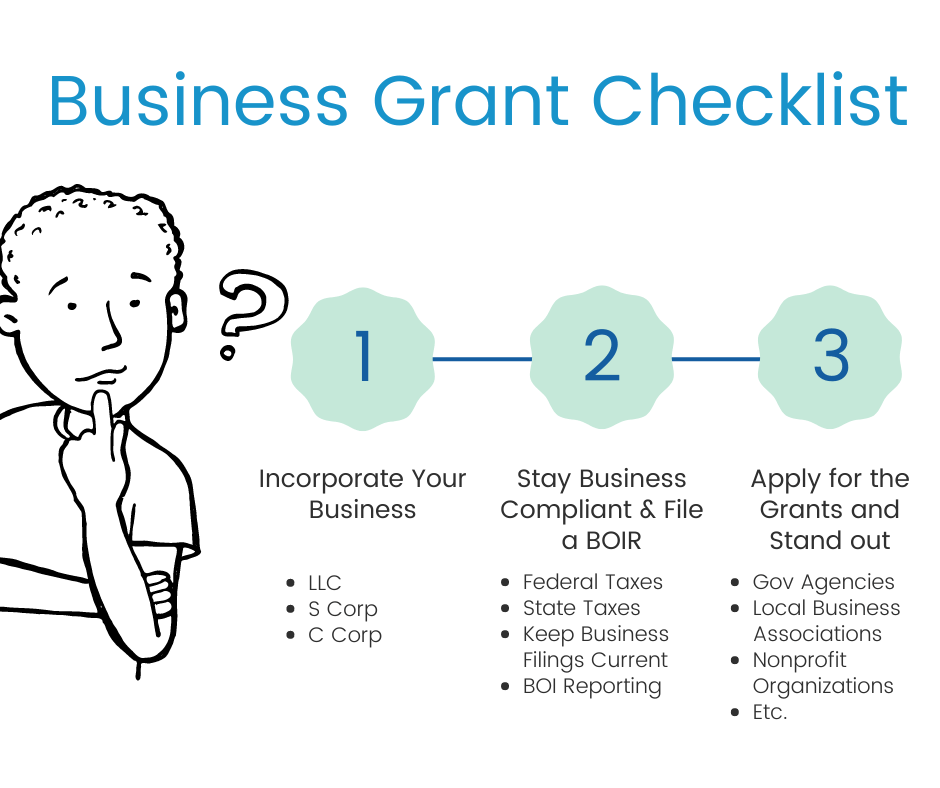

How to Know Your Business is Grant-Ready

As an entrepreneur in New Jersey, it’s crucial to understand that most small business grants, whether at the local or national level, typically require your business to be incorporated. This requirement is often in place to ensure that grant funds are allocated to legitimate, established businesses rather than individuals or informal ventures. Incorporation not only demonstrates your commitment to your business but also provides a legal structure that can make your enterprise more attractive to grant-giving organizations.

When it comes to incorporating your business, we’ve found that Northwest Registered Agent stands out as the best option for entrepreneurs. Their expertise in handling the incorporation process, combined with their exceptional customer service, makes them an invaluable partner for business owners. Northwest Registered Agent offers a streamlined approach to incorporation, ensuring that all necessary paperwork is filed correctly and efficiently, allowing you to focus on growing your business and pursuing those crucial grant opportunities.

Compliance and BOIR: Key Factors for Grant Eligibility Success

Compliance isn’t just a box to check; it’s your ticket to opportunity. For entrepreneurs in New Jersey, staying on top of federal and state taxes, and keeping business registrations current, isn’t just about avoiding trouble—it’s about opening doors to grants that could fuel your growth. Think of it as the price of admission to a world of possibilities.

The Corporate Transparency Act has added a new layer to this compliance puzzle, requiring businesses to file a Beneficial Ownership Information Report. While it might feel like another bureaucratic hurdle, view it as a chance to demonstrate your business’s integrity and commitment to transparency. Remember, the cost of compliance is always less than the price of getting caught unprepared.

That’s where we come in. Navigating the Beneficial Ownership Information Reporting (BOIR) requirements can be daunting, but our website simplifies the process. We offer a secure and straightforward filing experience with a direct connection to FinCEN, ensuring your information is handled with the highest level of security. Our platform makes compliance effortless so you can focus on growing your business.

Don’t let penalties slow your business down. Failing to comply with Beneficial Ownership Information Reporting (BOIR) requirements can result in severe consequences. If you fail to file, you could be subject to the following penalties:

- Fines of up to $500 per day for failure to file BOIR

- Cumulative fines reaching up to $10,000

- A person who willfully violates the BOI reporting requirements may be subject to criminal penalties of up to two years imprisonment.

Not sure if you have a BOIR filing requirement? Please take our quick BOI eligibility quiz to determine whether you need to file and ensure you comply with regulations.

Final Insights: Your Path to Business Grants in New Jersey

In the end, success in business often comes down to persistence and resourcefulness. New Jersey entrepreneurs have a wealth of grant opportunities at their fingertips, but it takes effort to uncover and pursue them. Remember, every bit of funding helps, and even small grants can make a big difference for a growing business. The key is to start exploring, stay determined, and not be afraid to ask for help along the way. Your next big break might be just an application away.

For all of you out there who haven’t yet tackled your BOIR, the time to act is now. Procrastination won’t get you anywhere, but taking just a few minutes to complete our straightforward form will. Don’t let this critical step in your compliance journey slip through the cracks—get it done and move forward with confidence.

Frequently Asked Questions

Have questions about the Beneficial Ownership Filing process? Check out FinCEN BOI Filing's frequently asked questions for the answer.

Are there penalties for not filing a BOI report?

Yes, failing to file a BOI report can result in substantial penalties, including hefty fines and potential legal repercussions. Learn more about the BOI deadlines and non-filing BOI penalties.

How do I file a BOI report?

Filing a BOI takes about 5-10 minutes and can be done here. If you’re not sure if you are required to file, you can take the one minute BOI Eligibility Quiz.

What is a BOI report?

Filing a BOI takes 5-10 minutes and can be done here. If you’re unsure if you are required to file, you can take the one minute BOI Eligibility Quiz.

What information is required in a BOI report?

You’ll need details of beneficial owners (name, address, ID number) and basic company information (name, address, registration details). Check out our ultimate guide to filing a BOI report for a complete list of items needed.

Who needs to file a BOI report?

Generally, most businesses, except for some exempt categories like publicly traded companies, are required to file a BOI report. For a comprehensive list of businesses who need to file, check out the essential guide to BOI reporting.

When is the BOI report due?

The due date for BOI reports varies based on jurisdiction and specific business circumstances. You can learn more about the BOI deadlines here.