Hey there, Northern Mariana Islands entrepreneurs! Are you ready to take your business to new heights, like the majestic peaks of Mount Tapochau? Let’s dive into the world of small business grants that could be your ticket to success, faster than a Saipan Dolphins touchdown.

Picture this: your business thriving like the vibrant coral reefs off Managaha Island. With the right grant, you could be expanding your operations, hiring more locals, or even opening a second location near the bustling Paseo de Marianas. In this article, we’ll explore where to find these golden opportunities and the steps you need to take to qualify, ensuring you’re as prepared as a seasoned Micro Beach diver. So, grab your favorite Marianas Coffee blend, and let’s get started!

Where to Search for Small Business Grants in Northern Mariana Islands

Opportunity knocks in the Northern Mariana Islands, where savvy entrepreneurs can uncover hidden gems of business potential. With a little digging and a keen eye, you’ll find that grants are waiting to be discovered, ready to fuel your entrepreneurial dreams in this Pacific paradise.

Some Northern Mariana Islands Local Resources Include:

Northern Mariana Islands’ Small Business Association: The SBA in Northern Mariana Islands is a treasure trove of resources for ambitious entrepreneurs seeking funding. They’re like that savvy friend who always knows where to find the best deals, except in this case, it’s all about connecting you with the right financial opportunities to fuel your business dreams.

The SBA in Northern Mariana Islands offers the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs. These grants are perfect for small businesses engaged in federal research and development with potential for commercialization. If you’re a tech-savvy entrepreneur with a groundbreaking idea, this could be your golden ticket to turning that innovation into a thriving business.

Northern Mariana Islands’ Economic Development Agency: Calling all entrepreneurial spirits in the Northern Mariana Islands! The Economic Development Agency is your treasure trove of resources for turning business dreams into reality. Whether you’re seeking funding, mentorship, or market insights, they’ve got your back with a smorgasbord of support tailored to local business needs.

Aspiring small business owners, listen up! The agency offers a small business grant program that could be your golden ticket to startup success. If you’re a resident with a solid business plan and a commitment to boosting the local economy, you might just qualify for this financial boost. It’s like finding a pearl in an oyster – rare, valuable, and potentially game-changing for your entrepreneurial journey.

Northern Mariana Islands’ Chamber of Commerce: The Chamber of Commerce in the Northern Mariana Islands is a goldmine for entrepreneurs seeking funding opportunities. They offer a wealth of resources, including workshops, networking events, and access to local investors, all designed to help business owners secure the capital they need to thrive in this unique market.

The Northern Mariana Islands Chamber of Commerce also provides a Small Business Development Grant program for eligible local entrepreneurs. This grant is available to businesses with fewer than 50 employees and annual revenues under $1 million, offering up to $10,000 in matching funds for various business development activities, including marketing, equipment purchases, and employee training.

Key Grant Opportunity for Entrepreneurs in Focus

Attention, entrepreneurs and small business owners in the Northern Mariana Islands! The Commonwealth Development Authority’s Micro Business Grant Program is a game-changing opportunity you don’t want to miss. This grant is specifically designed to support and empower micro-businesses, providing crucial financial assistance to help them grow and thrive. Whether you’re a startup looking to get off the ground or an established small business aiming to expand, this program could be the boost you need. To learn more about this exciting opportunity and how it can benefit your business, click here for all the details.

To qualify for the Micro Business Grant Program, you’ll need to meet certain criteria. The Commonwealth Development Authority is looking for dedicated entrepreneurs who are committed to contributing to the local economy. While specific requirements may vary, typically, you’ll need to demonstrate a solid business plan, show financial need, and prove that your business operates within the Northern Mariana Islands. Additionally, you may be required to participate in business development workshops or mentoring programs as part of the grant agreement. Remember, this program is designed to support serious, growth-oriented micro-businesses, so be prepared to showcase your potential and commitment to success.

Top Resources for Finding More Grants

When looking for small business grants, it may benefit you to look beyond the boundaries of Northern Mariana Islands. Skip is your one-stop platform for discovering and securing the funding you need to start or grow your business. With thousands of grants ranging from $1,000 to $25,000, finding the perfect opportunity is just a click away.

Imagine having access to a user-friendly dashboard where you can track and apply for grants tailored to your business in Northern Mariana Islands. Skip’s AI-assisted grant writing tool helps craft compelling applications that stand out, and with instant feedback, you can ensure your submission is top-notch every time.

Join the thriving community of entrepreneurs who have already reaped the benefits of Skip. With over $300,000 in grants donated and strong partnerships with government agencies and non-profits, Skip is dedicated to your success. Take the first step today and turn your business dreams into reality – Click Here to get started with Skip.

The Must-Have Criteria for Small Business Grants

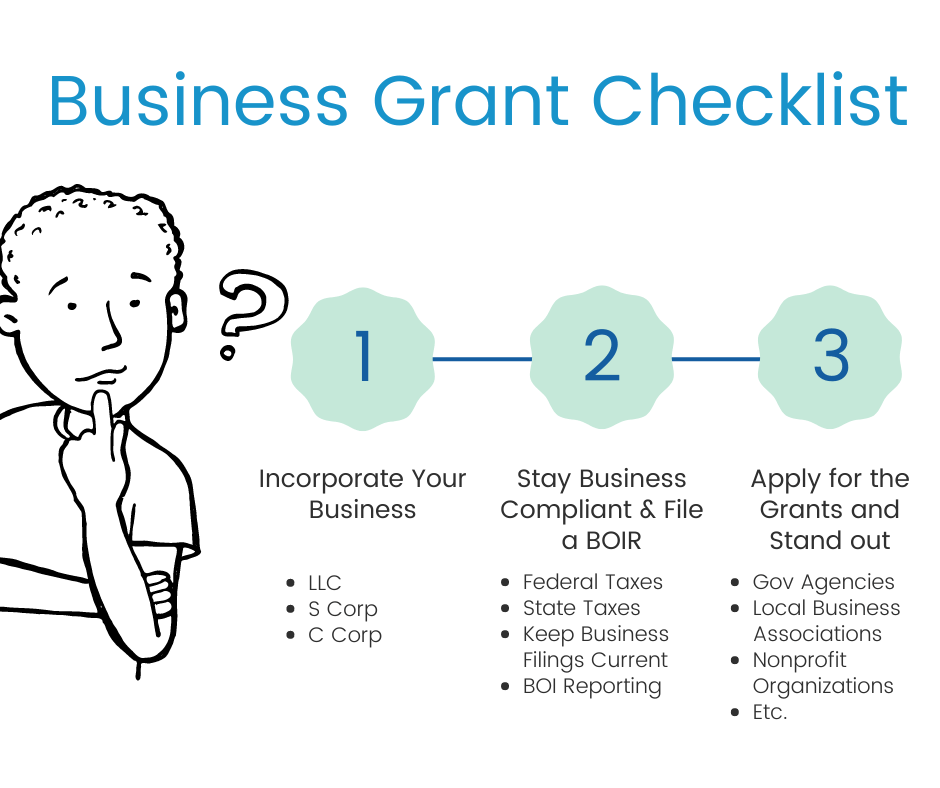

To qualify for most small business grants at local or national levels in the Northern Mariana Islands, organizations typically require that your business be incorporated. This legal structure not only enhances your credibility but also provides a formal framework for your operations. Incorporation can open doors to various funding opportunities and demonstrate your commitment to long-term business growth, which is often a key consideration for grant-giving bodies.

For entrepreneurs in the Northern Mariana Islands looking to incorporate their businesses, we have found that Northwest Registered Agent offers exceptional assistance. Their expertise in navigating the incorporation process, combined with their understanding of local regulations, makes them a valuable partner for business owners. Choosing Northwest Registered Agent can simplify the often complex incorporation procedure, allowing you to focus on developing your business while ensuring compliance with legal requirements.

The Critical Role of Compliance in Securing Grant Eligibility

Compliance isn’t just a box to tick; it’s your golden ticket to grant opportunities. For entrepreneurs in the Northern Mariana Islands, this means staying on top of federal and state taxes, if applicable, and keeping your business registration up-to-date. It’s the unglamorous work that paves the way for financial support and growth.

The Corporate Transparency Act has added a new layer to this compliance puzzle, requiring businesses to unveil their beneficial owners through a Beneficial Ownership Information Report. While it might feel like another bureaucratic hurdle, think of it as insurance against hefty fines that could derail your business dreams. In the grand scheme of things, it’s a small price to pay for peace of mind and legal standing.

That’s where we come in. Navigating the Beneficial Ownership Information Reporting (BOIR) requirements can be daunting, but our website simplifies the process. We offer a secure and straightforward filing experience with a direct connection to FinCEN, ensuring your information is handled with the highest level of security. Our platform makes compliance effortless so you can focus on growing your business.

Don’t let penalties slow your business down. Failing to comply with Beneficial Ownership Information Reporting (BOIR) requirements can result in severe consequences. If you fail to file, you could be subject to the following penalties:

- Fines of up to $500 per day for failure to file BOIR

- Cumulative fines reaching up to $10,000

- A person who willfully violates the BOI reporting requirements may be subject to criminal penalties of up to two years imprisonment.

Not sure if you have a BOIR filing requirement? Please take our quick BOI eligibility quiz to determine whether you need to file and ensure you comply with regulations.

In Summary: How to Find and Apply for Business Grants in Northern Mariana Islands

In the end, building a business is about more than just finding funding. It’s about resilience, adaptability, and the willingness to learn from both successes and failures. The resources available to entrepreneurs in the Northern Mariana Islands are tools, not guarantees. Use them wisely, but remember that your most valuable asset is your own determination and creativity. The path ahead may be challenging, but it’s in overcoming these challenges that you’ll find your true potential as an entrepreneur. Keep pushing forward, stay curious, and never underestimate the power of small, consistent steps towards your goals.

For all of you out there who haven’t yet tackled your BOIR, the time to act is now. Procrastination won’t get you anywhere, but taking just a few minutes to complete our straightforward form will. Don’t let this critical step in your compliance journey slip through the cracks—get it done and move forward with confidence.

Frequently Asked Questions

Have questions about the Beneficial Ownership Filing process? Check out FinCEN BOI Filing's frequently asked questions for the answer.

What is a BOI report?

A Beneficial Ownership Information (BOI) report is a filing required by FinCEN to disclose key details about individuals who own or control a company, ensuring compliance with anti-money laundering laws and enhancing corporate transparency. Filing a BOI takes 5-10 minutes and can be done here.

When does the CTA become effective?

The Corporate Transparency Act (CTA) reporting requirements take effect on January 1, 2024. Business entities established before this date have until January 1, 2025, to meet the reporting obligations.

Are there penalties for not filing a BOI report?

Yes, failing to file a BOI report can result in substantial penalties, including hefty fines and potential legal repercussions. Learn more about the BOI deadlines and non-filing BOI penalties.

How do I file a BOI report?

Filing a BOI takes about 5-10 minutes and can be done here. If you’re not sure if you are required to file, you can take the one minute BOI Eligibility Quiz.

Who is considered a beneficial owner?

A beneficial owner is any individual who either:

- Directly or indirectly exercises substantial control over the reporting company, or

- Directly or indirectly owns or controls 25% or more of the company’s ownership interests.

Substantial control includes the power to direct, influence, or determine significant decisions of the company. This may involve senior officers or individuals with authority to appoint or remove senior officers or a majority of the board.

Ownership interests encompass rights that establish ownership in the company, ranging from basic stock shares to more complex financial instruments.

For more details on “substantial control” and “ownership interests,” refer to our guide on complex ownership structures.

How do BOI reports get submitted to FinCEN?

We submit reports through a secure API connection directly with FinCEN’s Beneficial Ownership Secure System (BOSS). This integration allows for seamless and efficient filing of Beneficial Ownership Information reports, reducing the time it takes to complete and submit a report.

Our user-friendly form is designed to minimize errors by guiding you through the process with clear prompts and checks. Additionally, by using the secure API connection, we ensure that your data remains private and protected throughout the submission process, adhering to the highest security standards.

Who can access the beneficial ownership information?

The beneficial ownership information will be accessible only to authorized government agencies, such as law enforcement and regulatory authorities, for the purpose of combating money laundering, fraud, and other financial crimes.

This data is not publicly available and is used solely for compliance with legal and regulatory requirements. Only those with a legitimate need, as defined by the law, will be able to access this information to ensure transparency and uphold national security.

You can read more about keeping your personal information private when filing your BOIR.

Do I need to file a BOIR annually?

No, you do not need to file a Beneficial Ownership Information Report (BOIR) annually. However, you are required to update and file a new report if there are any changes to the beneficial ownership or company applicant information, such as changes in ownership or control. The report must be filed when there are material updates, but there is no annual filing requirement unless changes occur.

What information is required in a BOI report?

Type of Report

The reporting company must specify the type of report being submitted: an initial report, a correction of a prior report, or an update to a prior report.

Company Information

The reporting company must provide the following details:

- Legal Name: The official name of the company.

- Trade Name: Any “doing business as” (DBA) names used by the company.

- Address: The current street address of its principal place of business. If the principal place of business is outside the U.S., the company must report the address from which it conducts business in the U.S.

- Taxpayer Identification Number (TIN): This includes an EIN, SSN, or ITIN, as appropriate.

Beneficial Owner Information

The reporting company must provide the following details for each beneficial owner:

- Legal Name: The individual’s full legal name.

- Date of Birth: The individual’s date of birth.

- Address: The individual’s residential street address.

- Identification Document: A unique identifying number from an acceptable identification document, the issuing state or jurisdiction, and an image of the document.

Company Applicant Information (if required)

For reporting companies created on or after January 1, 2024, the following information about the company applicant must be provided:

- Address: The individual’s residential street address. If the applicant forms or registers companies as part of their business (e.g., paralegals), the business address can be used. The address does not need to be in the U.S.

- Identification Document: A unique identifying number from an acceptable identification document, the issuing state or jurisdiction, and an image of the document.

Who needs to file a BOI report?

Most businesses are required to file a BOI report, with exceptions for 23 specific categories, such as publicly traded companies and other regulated entities. To learn more about these exemptions and determine if your business needs to file, read this article.

When is the BOI report due?

- Companies formed or registered before January 1, 2024, must file an initial BOI report by January 1, 2025.

- Companies formed or registered in 2024 must file a BOI report within 90 days of receiving actual or public notice of their formation or registration.

- Companies formed or registered on or after January 1, 2025, must file their initial BOI report within 30 days of receiving actual or public notice.

You can learn more about the BOI deadlines here.

What is type of ID is required?

Acceptable identification documents include the following:

- A valid, unexpired driver’s license issued by a U.S. state or territory.

- A valid, unexpired ID card issued by a U.S. state, local government, or Indian Tribe for identification purposes.

- A valid, unexpired passport issued by the U.S. government.

- If none of the above is available, a valid, unexpired passport issued by a foreign government may be used instead.

An identification document must be collected for each beneficial owner.

For companies formed after 2023, an ID must also be provided for the company applicant.

Who is a company applicant?

A company applicant is the individual responsible for creating or registering a company. Specifically, it includes:

- The individual who directly files the document to form or register the entity with the relevant state or tribal authority, such as the Secretary of State.

- The individual primarily responsible for directing or controlling the filing process, even if they are not the one submitting it.

For companies formed or registered after January 1, 2024, this information must be reported as part of the Beneficial Ownership Information Report (BOIR).

Is it necessary to use a certified public accountant (CPA) or other professional to submit a BOI report?

Most individuals will be able to submit their Beneficial Ownership Information reports directly without needing assistance from attorneys or CPAs. Our streamlined, user-friendly form guides you through the process, making it simple to provide the required information accurately and efficiently.

Is a company required to update and correct information that is no longer accurate?

Yes, a company is required to update or correct its beneficial ownership information whenever it is no longer accurate. If there are any changes to the company’s beneficial owners or company applicant information, such as a change in ownership percentages or control, the company must file an updated report with the correct details. This ensures that the information on record remains accurate and compliant with the reporting requirements, helping to maintain transparency and reduce the risk of misuse.

Will I receive a confirmation of submission after submitting the BOIR?

After submitting your BOIR through our website, you will receive an email containing a unique submission process ID, confirming that your submission has been successfully received.

The email will also notify you once FinCEN has accepted your report. In rare instances, if your submission is rejected, we will inform you of the reason and provide a link to resubmit the corrected information.

You can track the status of all your submissions through our BOIR tracking page, ensuring you stay updated on the progress of your report. Most submission have a confirmed acceptance within a few minutes of submission.