Hey there, fellow Barbadian entrepreneur! If you’re running a business in Barbados but also operating in the USA, you’re probably familiar with the unique challenges that come with navigating compliance, legal, and beneficial ownership reporting requirements in both countries. From dealing with the Corporate Affairs and Intellectual Property Office (CAIPO) back home to understanding the intricacies of the US legal system, staying on top of these regulations can be a daunting task. But fear not, because in this blog, we’ll break down everything you need to know to ensure that your business stays on the right side of the law, no matter where you’re operating. So grab a Banks beer, sit back, and let’s dive into the world of compliance and reporting for Barbadian businesses in the USA.

Registration Requirements

The United States consists of 50 states and 5 territories, each with its own set of business regulations. To operate legally, businesses must adhere to both state-specific rules and federal laws.

State-Level Registration:

When establishing a business presence in the United States, businesses from Barbados must complete state-level registration in any state where significant business activities occur. This requirement typically applies if your company:

- Has a physical presence in the state

- Frequently meets with clients in the state

- Derives a significant portion of revenue from the state

- Has employees working in the state

Incorporating your Barbadian Company in the US

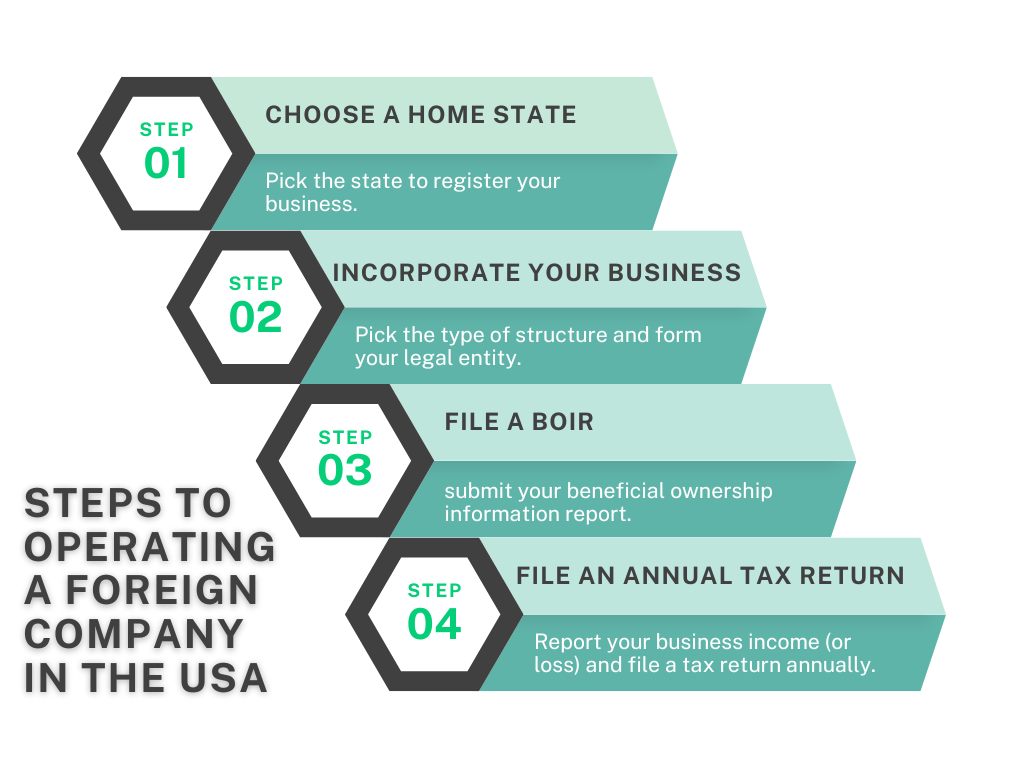

Even if none of the specific criteria apply, a Barbadian company must still choose a home state for registration when conducting business in the US. This involves forming a U.S. entity, such as a corporation, LLC, or other business structure, in that state. This registration ensures that the company is officially recognized and compliant with US regulations, regardless of its level of business activity in any individual state.

The newly formed U.S. entity will operate as a subsidiary of the foreign company. This means that while the U.S. entity is legally independent, it remains under the ownership and control of the parent company based in Barbados. This structure allows the company to conduct business in the US while maintaining its international headquarters.

We recommend using Northwest Registered Agent if your foreign company needs to incorporate. They offer expert guidance and can serve as a reliable registered agent for your business, ensuring compliance and smooth operations.

Federal Requirements

In addition to state requirements, Barbadian companies must also comply with federal regulations:

- Federal Tax ID: Obtain an Employer Identification Number (EIN) from the IRS. This number is essential for tax reporting and opening U.S. bank accounts.

- Industry Regulations: Companies may need to follow specific federal regulations depending on the industry. For example:

- Import/Export Laws: If the company is involved in importing or exporting goods, it must meet U.S. customs regulations. This includes adhering to rules for tariffs, duties, and necessary documentation.

Beneficial Ownership Information Reporting Requirements

For Barbadian businesses conducting operations in the U.S., adhering to Beneficial Ownership Information Reporting (BOIR) requirements is crucial. The Corporate Transparency Act mandates that companies disclose the individuals who own or control them. This applies to most entities, including those that are incorporated or registered in any U.S. state. The goal is to enhance transparency and combat illicit activities such as money laundering and terrorism financing.

A beneficial owner is an individual who controls the company or owns 25% or more of its shares, either directly or indirectly. For compliance with BOIR requirements, businesses must report information about these individuals, including their names, addresses, and identification details. Failure to file this report can result in significant penalties and legal consequences. Therefore, companies from Barbados need to ensure they meet these reporting obligations promptly and accurately.

For your convenience, you can file your Beneficial Ownership Information Report directly on our website. Click here to complete the process in just a few minutes and ensure your business complies with U.S. regulations.

Additional Considerations for Barbadian Businesses:

Tax Treaties

The tax treaty between the USA and Barbados offers significant advantages for businesses operating across both countries. This agreement helps prevent double taxation, ensuring that income is not taxed twice by both nations. It also provides clarity on tax rates and exemptions for various types of income, making financial planning more straightforward for Barbadian businesses in the USA. For more detailed information about the specific provisions and benefits of this tax treaty, click here to access the official IRS documents.

Trade Considerations

As a business operating in Barbados, it’s crucial to be aware of the Caribbean Basin Initiative (CBI), which provides duty-free access to the U.S. market for many products. Additionally, Barbados benefits from the Caribbean Basin Trade Partnership Act (CBTPA), offering preferential treatment for certain textile and apparel products. However, it’s essential to note that specific product categories may still be subject to tariffs or quotas. When exporting to the USA, ensure compliance with U.S. Customs and Border Protection regulations, including proper documentation and labeling requirements. For imports from the USA, familiarize yourself with Barbados’ customs procedures and any applicable duties or taxes. Always stay informed about updates to trade agreements and regulations, as they can impact your business operations and bottom line.

Your Path to Compliance: Key Takeaways for Barbadian Businesses in the U.S.

Operating a Barbadian business within the USA requires careful attention to legal obligations, from establishing your home state to incorporating and filing a beneficial ownership report. Meeting these requirements is essential for ensuring compliance and securing your business’s success in the American market. By understanding and adhering to these steps, you can confidently navigate the complexities of doing business in the U.S. and focus on growing your enterprise.

Ready to get started? Click here to file your BOIR in just a few short minutes. We make the process easy, fast, and secure so you can focus on what matters—your business.

Frequently Asked Questions

Have questions about the Beneficial Ownership Filing process? Check out FinCEN BOI Filing's frequently asked questions for the answer.

Are there penalties for not filing a BOI report?

Yes, failing to file a BOI report can result in substantial penalties, including hefty fines and potential legal repercussions. Learn more about the BOI deadlines and non-filing BOI penalties.

How do I file a BOI report?

Filing a BOI takes about 5-10 minutes and can be done here. If you’re not sure if you are required to file, you can take the one minute BOI Eligibility Quiz.

What is a BOI report?

Filing a BOI takes 5-10 minutes and can be done here. If you’re unsure if you are required to file, you can take the one minute BOI Eligibility Quiz.

What information is required in a BOI report?

You’ll need details of beneficial owners (name, address, ID number) and basic company information (name, address, registration details). Check out our ultimate guide to filing a BOI report for a complete list of items needed.

Who needs to file a BOI report?

Generally, most businesses, except for some exempt categories like publicly traded companies, are required to file a BOI report. For a comprehensive list of businesses who need to file, check out the essential guide to BOI reporting.

When is the BOI report due?

The due date for BOI reports varies based on jurisdiction and specific business circumstances. You can learn more about the BOI deadlines here.