Key Takeaways:

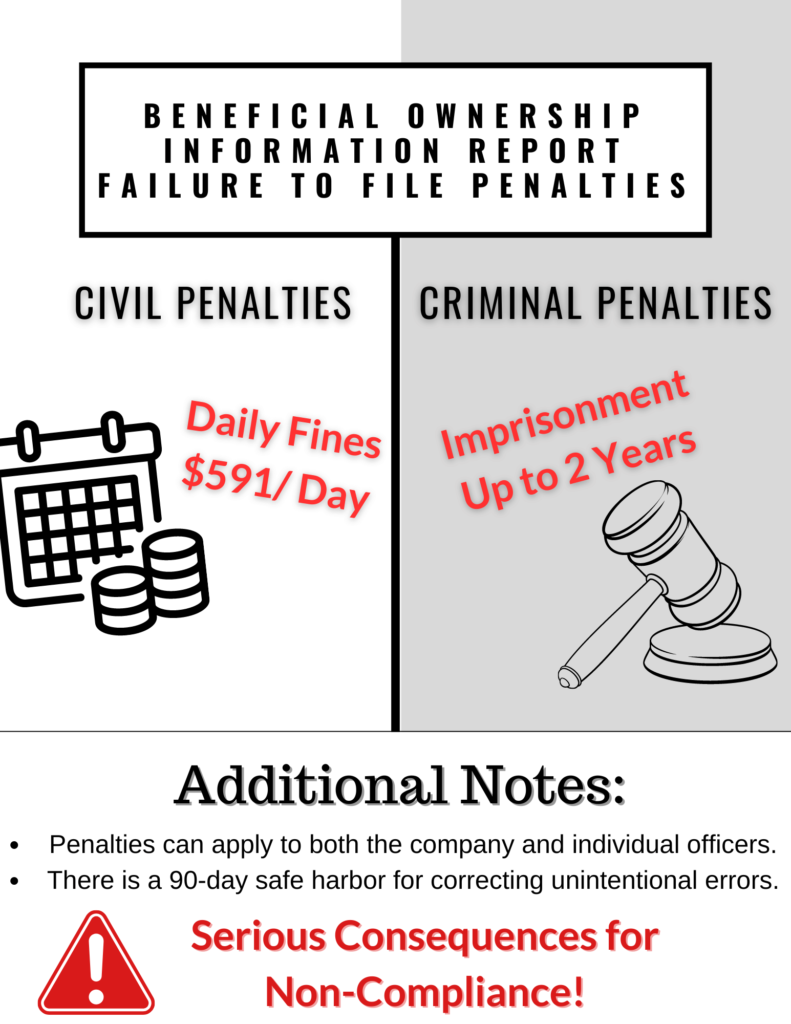

- Penalties for failing to file a Beneficial Ownership Information Report (BOIR) can be either criminal or civil.

- Penalties include daily civil fines and potential criminal charges for willful non-compliance.

- Utilizing compliance services can help avoid these significant penalties.

Compliance with the Corporate Transparency Act (CTA) is crucial for companies operating in the United States. The Financial Crimes Enforcement Network (FinCEN) requires businesses to file Beneficial Ownership Information (BOI) reports to enhance transparency and combat illicit financial activities. Failure to comply with these requirements can lead to severe civil and criminal penalties for both companies and individuals involved.

Consequences for Companies

When a company fails to file a BOI report as required, it faces significant penalties:

- Civil Monetary Penalty: Companies can incur a civil penalty of up to $500 for each day the violation continues. This penalty accumulates daily until the company complies with the filing requirements.

Consequences for Individuals

Senior officers, beneficial owners, or company applicants who willfully cause a company’s failure to file a BOI report can be held personally liable. The penalties for individuals include:

- Civil Penalties: Individuals can face civil penalties of up to $591 per day for each day the violation continues.

- Criminal Penalties:

- Imprisonment: Individuals may be sentenced to up to 2 years in prison for willfully failing to comply with the BOI reporting requirements.

- Criminal Fines: A fine of up to $10,000 can be imposed on individuals who willfully fail to provide required beneficial ownership information, provide false or fraudulent information, or cause the company’s failure to file a BOI report.

Specific Violations and Penalties

The penalties apply to individuals who:

- Willfully Fail to Provide Required Information: Not providing the necessary beneficial ownership information to the company can result in severe penalties.

- Provide False or Fraudulent Information: Submitting false or fraudulent information, knowing it will be reported to FinCEN, can lead to both civil and criminal penalties.

- Willfully Cause Non-Compliance: Deliberately causing the company to fail to file a required BOI report can result in fines and imprisonment.

Failure to File a BOIR Summary

The consequences of failing to file a BOI report with FinCEN are significant. Companies face steep daily fines for non-compliance, while individuals involved in willful violations can be held personally liable and face severe civil and criminal penalties, including imprisonment and hefty fines. Ensuring compliance with BOI reporting requirements is essential to avoid these severe repercussions.

Resources for Compliance

To assist with compliance, companies can use FinCENBOIFiling.com to streamline the BOI reporting process and avoid penalties. Additionally, taking a 2-minute BOI eligibility quiz can help determine if your company has a filing requirement.

For more information and to ensure your company meets all compliance requirements, visit our homepage.